Introduction: The Crypto Crossover in Payments

In the past decade, the payments industry has been defined by change. From mobile wallets to instant payments and buy-now-pay-later (BNPL) innovations, the speed and shape of money have evolved faster than regulation or legacy rails could adapt. Yet, amid these rapid shifts, a new paradigm is emerging, one that transcends speed and convenience. It’s the convergence of traditional payments and crypto infrastructure.

For Payment Service Providers (PSPs), this shift is a structural transformation in how value moves across borders, businesses, and ecosystems; not a buzzword or trend. Crypto, once dismissed as a speculative asset, is now powering cross-border settlements, stablecoin-based remittances, and embedded finance models that reduce friction and cost.

As global payment volumes increasingly blend fiat and digital assets, PSPs face a critical decision. They either evolve into crypto-enabled facilitators or risk obsolescence in a borderless financial future. Embedding crypto into PSP offerings is no longer a moonshot, it’s a strategic differentiator, offering both growth and resilience.

This article explores how PSPs can integrate crypto into their core business models and why it matters and how strategic execution can transform them from processors into pioneers.

Why PSPs Can’t Ignore Crypto Any Longer

The payments industry is shifting toward multi-asset interoperability, driven by user demand and market economics. Across industries, consumers and merchants are beginning to expect flexibility; whether paying in fiat, stablecoins, or tokens, without compromising compliance or experience.

According to Visa, crypto-linked card transactions surpassed $3 billion in volume within the first half of their pilot phase, signaling a rising demand for hybrid payment options. Meanwhile, Mastercard’s partnership with major crypto firms demonstrates that mainstream adoption is now operational and not hypothetical.

For PSPs, this evolution represents both a threat and an opportunity:

- Threat, because emerging fintechs and neobanks are rapidly capturing users with crypto-friendly features like wallets, on-ramps, and real-time conversions.

-

- Opportunity, because PSPs already own the critical infrastructure such as merchant networks, settlement engines, and trust needed to bridge traditional finance (TradFi) and decentralized finance (DeFi).

By embedding crypto capabilities, PSPs can:

- Tap into new transaction flows encompassing stablecoin settlements, and cross-border payrolls.

-

- Reduce dependency on correspondent banks for global transfers.

-

- Serve crypto-native businesses that need fiat rails.

-

- Improve liquidity management by accessing tokenized assets or stablecoin reserves.

The question is no longer “if” PSPs should engage, but “how fast they can adapt.” Waiting on the sidelines means letting fintechs define the next payments chapter, where the most agile players will command the rails of tomorrow.

The Strategic Case for Crypto Integration

At the strategic level, embedding crypto focuses on enhancing the existing payment stack to make it faster, cheaper and more inclusive without replacing fiat. These strategic drivers include:

Speed and Efficiency

Traditional cross-border transactions often rely on a connected network of correspondent banks, each adding latency and fees. A transfer that takes 2–5 business days through SWIFT can settle in under 10 seconds on-chain, especially when powered by stablecoins like USDC or USDT.

For PSPs, this speed translates to improved cash flow, instant merchant settlements, and superior customer experience in markets with slow local clearing systems.

Cost Reduction

Crypto rails significantly cut foreign exchange (FX) and intermediary costs. Instead of routing through multiple banks, PSPs can use blockchain-based liquidity pools to convert and settle directly, saving up to 70% of transaction costs in some corridors. These savings can either be passed to clients or reinvested into innovation.

Market Expansion

Stablecoin-enabled payments open new doors for PSPs in emerging markets. In regions with currency volatility or limited access to USD liquidity, stablecoins act as digital dollars, enabling cross-border commerce and remittance flows that traditional PSPs couldn’t previously reach.

Brand and Investor Positioning

Embedding crypto also positions PSPs as forward-thinking financial innovators, appealing to both institutional partners and investors seeking exposure to blockchain ecosystems. The narrative shifts from processor to platform, enhancing long-term enterprise valuation.

Financial Inclusion

By offering crypto payment options, PSPs can onboard the unbanked and underbanked; users with limited access to traditional banking but own mobile wallets or crypto apps. This is a growth-focused move that also builds relevance for the service provider.

Understanding the Integration Models

For PSP decision makers, the biggest concern is finding the best way to integrate crypto without disrupting the core business. Since there’s no one-size-fits-all solution, PSPs can choose from three primary models based on risk exposure levels, regulation, and technical readiness.

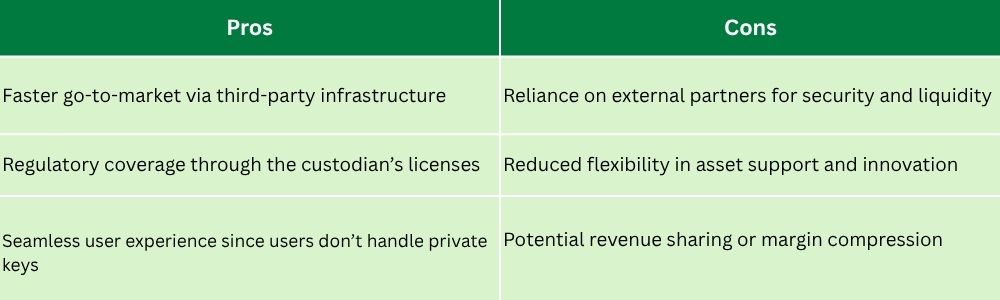

Model 1: Custodial Integration

In this model, the Payment Service Provider partners with licensed crypto custodians such as Fireblocks, BitGo, or Anchorage to manage digital assets on behalf of users. The custodian handles storage, security, and compliance, while the PSP focuses on the user interface and transaction logic.

Custodial setups are best for PSPs seeking speed and compliance-first integration particularly for pilot projects or early-stage expansion into crypto.

Model 2: Non-Custodial / Wallet-Based Integration

In this model, PSPs enable users to hold their own keys and wallets, interacting directly with blockchain networks. The Payment Service Provider role becomes one of facilitator and orchestrator, rather than custodian.

Non-custodial setups appeal to tech-forward PSPs or those building open financial ecosystems where control and trust are distributed.

Model 3: Hybrid Integration

The hybrid approach combines the best of both worlds. PSPs retain custodial flexibility for compliant fiat-crypto conversions but also support non-custodial wallets for advanced users or decentralized settlements.

This dual setup offers a pragmatic balance:

- Users can choose between custody options.

-

- PSPs maintain compliance while enabling innovation.

-

- The platform becomes future-proof as regulations evolve.

For example, a Payment Service Provider can use Fireblocks for institutional custody, then onboard an API provider like YoguPay for end-user remittance wallets. This combination ensures merchant settlements and consumer payments on-chain happen under one roof.

Embedding Crypto Through APIs and WaaS

In the modern payments ecosystem, speed to innovation determines survival. For PSPs, the challenge has shifted from entering the crypto space, to ways of integrating crypto capabilities without rebuilding their entire infrastructure.

This is where APIs and Wallet-as-a-Service (WaaS) platforms thrive in. They serve as the connective layer between legacy PSP systems and blockchain networks, turning what was once a multi-year engineering effort into a matter of weeks.

The Role of WaaS Providers

Wallet-as-a-Service (WaaS) providers are the infrastructure backbone of modern crypto adoption. Instead of Payment Service Providers having to build and secure their own blockchain systems, from key management, custody, network integration, and smart contract logic, WaaS providers deliver these functions through ready-made, compliant APIs.

WaaS Platforms enable PSPs to:

- Launch crypto wallets instantly for users or merchants, fully integrated into existing interfaces.

-

- Automate fiat-to-crypto and crypto-to-fiat conversions, powered by liquidity partners.

-

- Integrate on/off ramps across major fiat corridors such as the United States Dollar (USD), Euro (EUR), Kenyan Shillings (KES), and Nigerian Naira (NGN), reducing remittance and conversion latency.

-

- Embed compliance automation through built-in KYC, AML, and Travel Rule frameworks for cross-border transactions.

-

- Support multiple blockchains from Ethereum to Polygon, Stellar, and Solana, without additional engineering.

-

- Offer stablecoin-denominated accounts, allowing users to hold and transact in digital dollars seamlessly.

The result is a modular and interoperable payments ecosystem, where PSPs can roll out crypto functionality without dismantling existing infrastructure. Payment Service Providers should approach it as a plug-and-play transformation, instead of a tear-and-replace one.

Why APIs and WaaS Are Game-Changers for PSPs

For decades, PSPs relied on static infrastructure bound by card networks and banks. APIs and WaaS have changed that dynamic, enabling them to extend their capabilities in real time.

This shift introduces several strategic advantages:

Accelerated Go-To-Market (GTM) Cycles

With Wallet-as-a-Service, launching crypto-enabled products takes weeks instead of years. PSPs can pilot stablecoin wallets, crypto settlements, or cross-border corridors with minimal development overhead.

Reduced Operational Costs

WaaS eliminates the need for heavy infrastructure investments like data centers, blockchain nodes, or security hardware by handling the backend, allowing PSPs to focus resources on product differentiation.

Future-Proof Interoperability

Most WaaS APIs are compatible across multiple chains, and upgradeable, meaning PSPs can adapt to new blockchains or token standards as they emerge; particularly Central Bank Digital Coins (CBDCs).

Scalability and Reliability

WaaS providers often operate at enterprise-grade scale, offering high uptime Service Level Agreements (SLAs), audited security standards, and custody insurance. PSPs benefit from institutional-grade resilience without the corresponding overhead.

Compliance and Trust-by-Design

Because WaaS providers are often licensed entities or work with regulated custodians, PSPs gain a compliance-aligned foundation from day one; crucial for gaining regulator confidence.

Use Case Example: WaaS in Action for a Regional PSP

Imagine a Payment Service Provider operating across Africa serving SMEs that need affordable, fast, and reliable cross-border payments.

By integrating WaaS APIs, this PSP could:

- Enable merchants to accept payments in stablecoins (USDC, USDT) and instantly settle in their local fiat currency (KES, NGN, ZAR).

-

- Automate cross-border payroll distribution, where businesses pay freelancers or suppliers in stablecoins, while recipients withdraw in fiat through mobile money integrations.

-

- Provide multi-currency digital accounts, allowing users to hold both local currency and stablecoins in one dashboard.

-

- Manage treasury liquidity across multiple markets using blockchain rails, reducing FX costs and settlement delays.

From a strategic standpoint, this turns a traditional PSP into a multi-asset, multi-rail payment orchestrator that bridges the gap between fiat and crypto without forcing end-users to learn blockchain mechanics.

The outcome is a stronger value proposition for merchants and SMEs: faster settlements, lower fees, and new revenue opportunities through crypto liquidity.

Expanding the API Stack for Crypto Integration

Beyond WaaS, a PSP’s crypto readiness depends on building an API-first architecture that interconnects key services across compliance, liquidity, and reporting.

A modern crypto-enabled PSP typically integrates:

WaaS APIs – For wallet creation, management, and user-level crypto functionality.

On/Off Ramp APIs – For fiat conversions or cross-border settlement via partners like YoguPay who offer compliance-first APIs for scaling cross-border settlements.

Exchange and Liquidity APIs – For price feeds, swaps, and stablecoin liquidity sourcing.

Compliance APIs – For real-time identity verification, blockchain analytics, and transaction monitoring.

Data and Reporting APIs – For internal audits, reconciliation, and regulator reporting.

By orchestrating these APIs within a unified backend, Payment Service Providers can build customizable payment ecosystems that evolve with market demands, rather than being locked into rigid, legacy architectures.

Building a Compliance-First Tech Stack

Crypto innovation can only succeed when paired with regulatory discipline, meaning Payment Service Providers entering this space must design compliance as a core design pillar and not as an afterthought.

A compliant crypto stack for PSPs should include:

- On-Chain Analytics Tools

Platforms like Chainalysis or TRM Labs help PSPs track wallet behavior, flag high-risk transactions, and prevent illicit activity in real time.

- Dynamic KYC/AML Verification

Partner with identity providers offering global verification, biometric checks, and document validation via API. YoguPay, for instance, deploys automated KYC/AML workflows to streamline compliance and accelerate cross-border payment processing.

- Transaction Monitoring and Screening

Set up real-time alerts for abnormal transaction patterns, sanctioned wallet addresses, or unusual volume spikes. Solutions like YoguPay integrate AI-driven monitoring and sanctions screening to help PSPs detect risks early and maintain compliance across markets.

- Automated Regulatory Reporting

WaaS platforms and compliance APIs can auto-generate reports that align with FATF, MiCA, or local VASP requirements, reducing audit friction and improving transparency.

- Travel Rule Compliance

Enable data sharing across PSPs for cross-border crypto transfers, ensuring traceability of senders and receivers in line with FATF standards.

By integrating compliance functions into the same API layer as payment operations, PSPs can turn regulation into a competitive advantage, signaling maturity, trust, and readiness to both regulators and institutional clients.

Regulatory and Risk Considerations

Crypto integration cannot outpace regulation, and the PSPs that succeed are those that align innovation with compliance from day one.

Global Regulatory Alignment

Around the world, regulators are converging to make digital assets safer, transparent, and compatible with traditional payments. For PSPs, this marks a shift from uncertainty to opportunity.

Europe — MiCA and Regulated Crypto Payments

The EU’s Markets in Crypto-Assets (MiCA) regulation introduces a unified licensing regime for crypto and stablecoin providers. PSPs can now operate with legal clarity and “passport” licenses across member states.

United States — GENIUS Act and Stablecoin Integrity

The GENIUS Act cements stablecoins as credible financial tools by mandating 1:1 reserve backing, regular audits, and federal oversight. For PSPs, it unlocks a compliant pathway to use stablecoins for faster, dollar-linked cross-border payments.

Africa — Kenya’s VASP Bill and DAT Framework

Kenya’s Virtual Asset Service Provider (VASP) Bill and Digital Asset Tax (DAT) framework aim to balance innovation with accountability. By licensing crypto-enabled services, regulators are providing PSPs with a clear compliance route to operate securely and scale across Africa.

Compliance as a Strategic Asset

Operating within clear frameworks like MiCA or the VASP regime allows PSPs to build trust with banks, regulators, and institutional clients while accelerating market entry. Those that invest early in automated reporting, on-chain analytics, and AI-driven KYC tools turn compliance from a cost center into a value engine that protects reputation, reduces operational risk, and strengthens user confidence in every transaction.

Managing Risk Exposure

Crypto introduces new categories of risk:

- Volatility Risk — Mitigated by using stablecoins or instant conversion.

-

- Custodial Risk — Addressed via insured custodians or multi-signature wallets.

-

- Regulatory Risk — Managed by securing VASP or EMI licenses.

Incorporating risk management frameworks early not only ensures compliance but also enhances institutional trust, especially when courting enterprise clients.

Operational Controls

Forward-looking PSPs also develop incident response playbooks for blockchain environments; covering lost keys, fraud detection, and dispute resolution. These controls reflect maturity and reassure both regulators and partners.

Building a Seamless User Experience

While crypto introduces powerful backend capabilities, user experience (UX) determines adoption. A PSP’s crypto offering must be as intuitive as tapping a card, a case of invisible complexity turning into visible reliability.

Simplifying Onboarding

Users should be able to create crypto wallets and verify identities in under two minutes, reinforcing the need for integrating streamlined KYC flows with digital identity providers. Any additional friction risks abandonment.

Transparent Conversion and Fees

The value proposition lies in transparency, showing real-time exchange rates, transaction fees, and network status builds user confidence and reduces disputes.

Cross-Asset Fluidity

Users shouldn’t have to think about whether they’re paying in fiat or crypto. Smart routing systems can automatically determine the most efficient payment path, whether on-chain or off-chain based on speed and cost.

Trust and Education

PSPs that lead with education through tutorials, pop-ups, and guides can accelerate crypto adoption among non-native users. When customers understand how stablecoins or blockchain settlements work, they’re more likely to use them consistently.

Merchant Enablement

For B2B payment services, merchant dashboards should offer real-time analytics on both fiat and crypto flows, including conversions, settlements, and liquidity positions. Empowering merchants to visualize their performance in one place drives loyalty.

The Crypto-Native PSP in a Tokenized World

As the line between traditional and decentralized finance blurs, PSPs are uniquely positioned to define the next era of financial interoperability.

From Processor to Platform

Tomorrow’s Payment Service Providers will not just process payments, they will orchestrate value flows across fiat, crypto, and tokenized assets. A crypto-native PSP can manage liquidity across multiple chains, enabling instant global commerce with programmable logic.

Tokenization and DeFi Integration

The next evolution involves integrating tokenized deposits, CBDCs, and DeFi protocols. PSPs could allow merchants to earn yield on idle balances via regulated DeFi channels, turning payments infrastructure into financial optimization engines.

Interoperability and Network Effects

Cross-chain interoperability protocols will allow PSPs to bridge assets seamlessly across ecosystems, reducing silos. Early adopters will gain a network advantage by being multi-chain from day one.

Strategic Partnerships

Success will hinge on ecosystem collaboration; from partnering with blockchain infrastructure providers to aligning with banks and regulators. PSPs that build open ecosystems, instead of walled gardens, will scale faster.

New Revenue Streams

By embedding crypto, PSPs unlock new income sources:

- Conversion and FX fees on digital assets

-

- Custody and staking services

-

- API monetization for third-party developers

-

- Data insights from blockchain transaction analytics

Conclusion: The Competitive Edge of Early Adoption

The payments landscape is entering a new phase, where the winners simplify crypto’s complexity into secure, compliant user experiences. For PSPs, embedding crypto is no longer experimental, but a strategic move that ensures resilience and relevance. By leveraging stablecoins, WaaS infrastructure, and hybrid custody models, they can cut costs and unlock new value streams.

In a world built on trust and transaction, the next generation of PSPs will bridge traditional and digital finance. YoguPay’s API-driven infrastructure empowers them to do just that, enabling seamless, compliant cross-border payments that move value without borders.

To learn more, visit www.yogupay.com or contact us to explore how YoguPay can help your business embed crypto into its payment stack.