Introduction

Over-the-counter (OTC) crypto trading has evolved from a niche segment of the blockchain ecosystem into one of its most powerful engines for growth and scalability. Today, OTC desks handle billions in daily transactions, serving institutional investors, hedge funds, family offices, and high-net-worth clients who require large-volume trades executed outside public exchanges. These trades, often involving Bitcoin, Ethereum, stablecoins, or tokenized assets, demand not only liquidity and discretion but also absolute trust in the underlying infrastructure.

Yet as OTC volumes and client expectations surge, so too do operational and regulatory pressures. Manual settlements, fragmented wallets, and inconsistent security protocols can easily expose desks to financial, reputational, or compliance risks. Institutions now expect OTC providers to deliver faster execution, backed by bank-grade security, real-time settlement, and full end-to-end transparency.

This expectation paved the way for the Wallet-as-a-Service (WaaS); a new generation of institutional wallet infrastructure that allows OTC desks to scale securely without building everything from scratch. This model is transforming how OTC desks manage custody, settlement, and risk in the digital asset era.

This article explores how Wallet-as-a-Service technology empowers OTC desks to achieve operational efficiency, regulatory compliance, and scalable security; enabling them to compete confidently in an increasingly institutionalized crypto market.

Understanding Wallet-as-a-Service (WaaS)

Wallet-as-a-Service (WaaS) refers to a managed digital asset infrastructure that provides secure wallet management, key storage, and transaction orchestration through APIs or white-label interfaces. In essence, WaaS allows institutions to integrate wallet functionality into their existing operations without building proprietary custody systems.

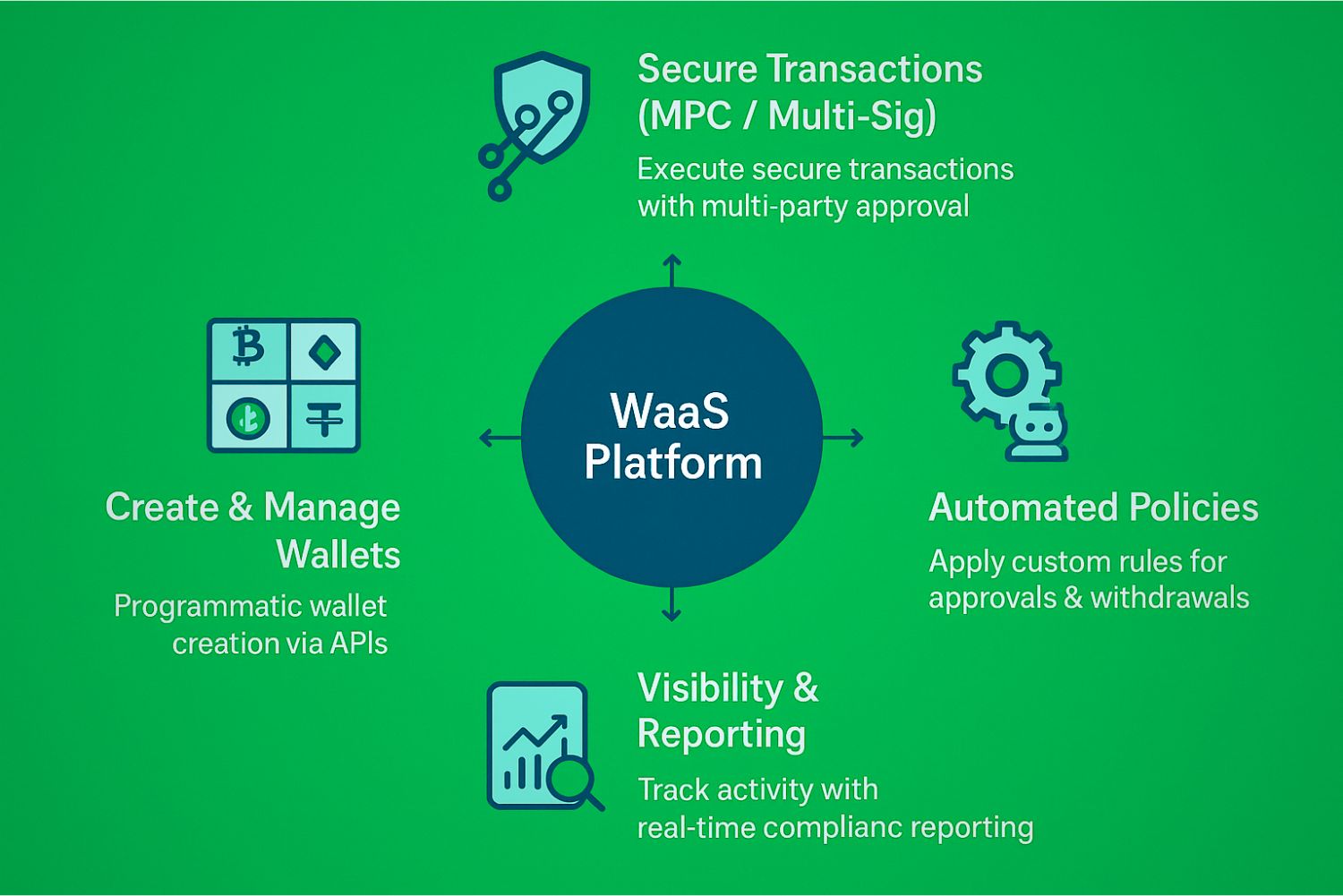

Instead of manually generating wallets or handling private keys, OTC desks can use WaaS platforms to:

- Create and manage multiple wallets programmatically.

-

- Execute transactions using multi-signature or MPC security.

-

- Apply automated policies for approvals and withdrawals.

-

- Maintain regulatory-grade visibility and reporting.

WaaS platforms operate much like cloud infrastructure for digital assets. They are secure, scalable, and always available and typically leverage:

- Multi-Party Computation (MPC) or Hardware Security Modules (HSMs) to ensure private keys are never fully exposed.

-

- Role-based access controls to segregate duties between traders, operations, and compliance.

-

- Programmable wallets for conditional transfers and automated workflows.

-

- Integrated audit logs and compliance APIs for transparency.

Unlike custodians that hold client assets on their own balance sheet, WaaS solutions empower OTC desks to retain control over funds while outsourcing the complexity of secure wallet management. The result is a balance between autonomy, compliance, and institutional-grade security; a crucial combination for any desk managing large-volume trades.

Providers like YoguPay extend this model through API-driven WaaS infrastructure that combines MPC-secured wallets with cross-border settlement capabilities. For OTC desks, this means the ability to manage multi-asset transactions, automate treasury workflows, and settle trades seamlessly across fiat and crypto networks through a single, programmable interface.

The Operational Challenges OTC Desks Face Today

While OTC desks have matured over the past few years, many still operate with legacy processes and fragmented technology stacks. These issues, once manageable, now pose significant risks as the market scales.

1. Fragmented Wallet Infrastructure

Many desks juggle multiple wallets across different exchanges and custodians, making it difficult to maintain a real-time view of asset positions. This fragmentation slows down settlements and introduces reconciliation errors.

2. Manual Settlement Processes

A surprising number of OTC desks rely on spreadsheets, messaging apps, and manual approvals to confirm and settle trades. This lack of automation exposes them to operational inefficiencies and human error.

3. Security Vulnerabilities

Private key management remains one of the biggest pain points. Unencrypted backups, shared access credentials, and hot wallet overexposure make desks vulnerable to insider threats and cyberattacks.

4. Liquidity and Counterparty Risks

Because of slow settlements and fragmented infrastructure, counterparties often face delays or pre-funding requirements which ties up liquidity and limits trading throughput.

5. Compliance Pressure

With FATF’s Travel Rule, AML/KYC obligations, and region-specific regulations (like MiCA in the EU or the VASP Act in Kenya), OTC desks face a growing compliance burden that traditional wallet systems can’t easily address.

6. Scalability Barriers

As trade volumes grow, adding new counterparties or token support becomes resource-intensive without flexible infrastructure. For desks aiming to expand globally, scalability is no longer optional.

These challenges collectively underscore why a new approach to wallet management is critical; one that offers automation, security, and compliance built into the core architecture.

How Wallet-as-a-Service Solves These Problems

Wallet-as-a-Service platforms directly address the bottlenecks OTC desks encounter by introducing automation, standardization, and security at every level of operation.

1. Centralized Infrastructure, Decentralized Control

WaaS consolidates wallet management into one secure dashboard or API framework. OTC desks manage hundreds of wallets across multiple blockchains from a single interface; while still maintaining granular control through role-based permissions.

2. Automated Settlements and Workflows

Trade confirmations, approvals, and fund transfers can be automated through programmable policies, eliminating the need for manual multi-signature coordination and drastically reduces settlement times.

For instance, YoguPay’s API suite allows OTC desks and payment providers to automate crypto-to-fiat or cross-border digital transfers in real time. By integrating directly with WaaS infrastructure, YoguPay enables seamless remittances and settlements between counterparties without the delays of manual fund movement.

Through programmable APIs, OTC desks can trigger transfers, execute payouts, or settle trades instantly; eliminating the friction traditionally associated with multi-chain and multi-jurisdictional transactions.

3. Security by Design

MPC and HSM technologies ensure private keys are never held in a single location. Even if one system component is compromised, no attacker can reconstruct the full signing key.

Policy controls such as whitelisted addresses, spending limits, and multi-approver requirements add multiple defense layers against internal or external threats.

4. Seamless Integrations

WaaS APIs plug directly into exchanges, liquidity pools, custodians, and banking partners, giving OTC desks unified access to their digital asset ecosystem. Real-time data visibility improves capital management and compliance monitoring.

5. Built-in Compliance Tools

Leading WaaS providers integrate AML/KYC systems, address-screening solutions, and Travel Rule compliance modules. These features help OTC desks meet global regulatory standards without building their own compliance stack.

6. White-Label and API-First Architecture

Desks can use WaaS as a branded wallet layer for their clients to enhance trust and transparency while maintaining operational control. In short, WaaS converts what used to be a patchwork of tools and spreadsheets into a secure, automated, and compliant operating backbone.

Security First: Why WaaS Is Ideal for High-Value OTC Transactions

For OTC desks managing multimillion-dollar transactions, security is fundamental. WaaS platforms are designed from the ground up to eliminate single points of failure while maintaining institutional-grade access controls.

1. Multi-Party Computation (MPC) Security

MPC divides the private key into multiple encrypted shards stored across independent servers. Transactions are signed collaboratively without ever reconstructing the full key. This model drastically reduces risks associated with insider threats or compromised devices.

A leading example is YoguPay, which employs Multi-Party Computation (MPC) to secure its wallet and transfer APIs. By splitting private keys across independent nodes, YoguPay ensures that no single compromise can expose credentials or assets, a design aligned with institutional-grade WaaS standards.

This design mirrors institutional WaaS standards, offering users and partner OTC desks a secure, tamper-resistant environment for executing high-value transfers and remittances.

2. Cold–Hot Wallet Orchestration

WaaS solutions intelligently manage fund flows between cold, warm, and hot wallets based on risk thresholds and liquidity needs. This hybrid model balances accessibility with long-term security.

3. Role Segregation and Policy Controls

Permissions can be assigned by role; either trader, compliance officer, or administrator, to prevent a single individual from authorizing large transactions unilaterally. Multi-factor authentication and approval workflows further strengthen oversight.

4. Compliance and Audit Assurance

Every transaction is logged immutably with cryptographic proof, and respective audit trails can be exported for regulators, auditors, or internal governance, simplifying compliance reporting.

Compared to traditional single-custodian wallets, WaaS architecture minimizes both operational and custodial risk, delivering security on par with institutional capital markets. With this foundation, innovators in Ghana can launch stablecoin wallets rapidly; bypassing the months typically required to build secure custody infrastructure from the ground up.

Enabling Scale: WaaS as a Growth Engine for OTC Desks

Scaling an OTC desk requires infrastructure that can handle growth without compromising compliance or efficiency. WaaS provides precisely that foundation.

1. Speed and Automation

By automating wallet creation, settlement, and fund movement, WaaS removes the bottlenecks of manual operations. API-driven transfers mean trades can be confirmed and settled in seconds rather than hours.

2. Multi-Client Architecture

Wallet-as-a-Service platforms allow OTC desks to segregate funds per client, trading strategy, or asset type, ideal for managing institutional accounts or liquidity partners at scale.

3. Operational Efficiency

With automated reconciliation and unified reporting, back-office workload decreases significantly. Teams can reallocate resources from operations to client growth and liquidity sourcing.

4. Cost Optimization

Building and maintaining an in-house custody system is expensive and resource-heavy. WaaS reduces infrastructure costs while providing enterprise-level SLAs, uptime guarantees, and support.

5. Multi-Chain Support

As OTC trading expands into new asset classes like DeFi tokens, wrapped assets, and tokenized treasuries; WaaS enables multi-chain interoperability through unified APIs. A provider like YoguPay extends this capability further, empowering OTC desks and fintech platforms to facilitate seamless cross-border remittances and settlements across fiat and digital currencies.

By abstracting blockchain complexity, YoguPay enables seamless, high-speed value transfers between global counterparties. Whether moving USDT from Kenya to Europe or settling stablecoin trades between PSPs, YoguPay provides a secure, low-cost, and regulation-ready infrastructure for cross-border digital settlements.

Example:

A mid-tier OTC desk scaling from $5 million to $100 million in monthly volume can leverage WaaS to automate settlements, onboard clients in hours instead of days, and maintain full audit compliance, all without increasing headcount. The same principle applies to remittance companies facilitating crypto payouts to over 100 countries securely and compliantly, without reinventing the infrastructure wheel.

Compliance, Governance, and Transparency at Scale

Compliance remains one of the most resource-intensive functions for OTC desks. WaaS platforms simplify this complexity through automation and visibility.

1. Global Regulatory Alignment

Modern WaaS providers align with evolving frameworks such as the EU’s MiCA, the GENIUS Act in the U.S., and emerging VASP regulations across markets like Singapore, Hong Kong, and Kenya—ensuring compliant, transparent, and globally interoperable digital asset operations.

2. Embedded AML and Risk Tools

Through API integrations, WaaS can automatically screen wallet addresses, detect suspicious transactions, and integrate with existing AML vendors. This helps OTC desks stay ahead of potential violations. YoguPay enhances this layer with automated AML and transaction-risk checks, ensuring every transfer is screened for compliance in real time without slowing down settlements.

3. Automated Audit Trails

Every wallet action, from creation, to transaction, and approval is recorded unchangeably. These logs create regulator-ready reports and reduce the time spent preparing for audits.

4. Governance and Role Management

Desks can establish layered approval policies for high-value transactions, ensuring transparent accountability across trading and compliance teams.

In an increasingly regulated environment, WaaS acts as a compliance multiplier, giving OTC desks institutional-grade governance without slowing down operations.

Choosing the Right WaaS Provider for Your OTC Desk

Not all Wallet-as-a-Service solutions are equal. Selecting the right provider requires balancing security, scalability, and compliance readiness.

Key Evaluation Criteria

- Security Architecture: Look for MPC or HSM technology, SOC 2 certification, and independent penetration audits.

- Regulatory Alignment: Providers should comply with GDPR, ISO/IEC standards, and relevant digital asset regulations.

- Integration Flexibility: Assess API documentation quality, SDK availability, and compatibility with your trading stack.

- Multi-Chain Support: Ensure coverage for Bitcoin, Ethereum, stablecoins, and other commonly traded assets.

- Service-Level Guarantees: 99.9% uptime, redundant infrastructure, and 24/7 support are essential for institutional operations.

- White-Label or API-Only Options: Depending on whether you want client-facing branding or backend integration.

Questions to Ask Potential Providers

- How are private keys generated and stored?

-

- Is your platform compliant with FATF and local VASP rules?

-

- How does your system handle transaction policies and approvals?

-

- What’s your SLA and incident response framework?

Beyond providing technological infrastructure, the ideal Wallet-as-a-Service partner offers institutional trust, operational maturity, and regulatory foresight. YoguPay embodies this philosophy through its security-by-design architecture, programmable compliance, and cross-border scalability: positioning it as a reliable API partner for OTC desks, PSPs, fintechs, and financial institutions looking to scale securely in the digital asset economy.

Case Study Snapshot: WaaS in Action for an OTC Desk

Scenario:

A mid-size OTC desk specializing in crypto-stablecoin trades was struggling with fragmented wallets, manual settlements, and delayed reconciliations.

Solution:

The desk integrated YoguPay’s interoperability infrastructure, which leverages MPC-based wallet management and programmable APIs. for instant settlements and compliance automation. This programmable solution automated trade settlements, applied policy-based transaction approvals, and connected directly to the desk’s liquidity partners.

Outcome:

- Settlement time reduced by 70%

-

- Operational errors dropped by 90%

-

- Real-time compliance monitoring across all transactions

-

- Instant client wallet creation and segregation

This transformation allowed the desk to onboard more clients, improve capital efficiency, and meet regulatory audit requirements seamlessly.

The Future of OTC Desks in a WaaS-Powered World

Over time, OTC desks that leverage WaaS will evolve from mere liquidity providers into institutional gateways for the digital asset economy; built on infrastructure that matches, and often surpasses, traditional financial systems.

OTC trading is entering a new phase shaped by automation, interoperability, and embedded compliance. As tokenization expands and assets migrate on-chain, OTC desks must evolve from manual systems to digital-first, API-driven operations.

Wallet-as-a-Service (WaaS) lies at the heart of this shift by:

- Enabling instant, cross-chain settlements through programmable wallets.

-

- Integrating AI-powered risk monitoring and predictive analytics.

-

- Supporting tokenized securities and emerging asset classes.

-

- Ensuring seamless interoperability with DeFi protocols and regulated exchanges.

- Platforms like YoguPay are already leading this transformation, merging programmable wallets, MPC security, and embedded compliance to help OTC desks scale with institutional precision.

Conclusion: Scaling Without Sacrificing Security

In the high-stakes world of OTC crypto trading, scale and security must advance together. Wallet-as-a-Service offers OTC desks a powerful way to modernize their operations, reduce risk, and meet institutional expectations without building complex infrastructure in-house.

What cloud computing did for software, Wallet-as-a-Service is doing for OTC infrastructure. The desks that embrace it today will define the standard for secure, scalable, and compliant digital asset trading tomorrow.

To learn how YoguPay empowers OTC desks, PSPs, and fintechs to scale with confidence, visit yogupay.com or contact us to explore a tailored integration solution for your business.