As regulation and digital finance mature across Africa, stablecoins are increasingly positioned as complementary settlement rails, bridging gaps between traditional banking systems and modern, API-driven financial services. For fintech innovators and payment service providers (PSPs), choosing the right stablecoin is both a technical and strategic decision that influences liquidity, compliance, cross-border settlement efficiency, and the ability to serve customers reliably.

Among the stablecoins in widespread use today, Tether (USDT) and USD Coin (USDC) dominate conversations. Both offer USD-pegged stability, but they differ significantly in governance, transparency, adoption patterns, and ecosystem support.

This article dissects the underlying differences between USDT and USDC, evaluates their implications for African fintechs and PSPs, and outlines practical considerations for implementation, highlighting the role of WaaS and settlement API infrastructure providers like YoguPay in simplifying integration and scaling cross-border settlement.

Why Stablecoins Matter for African Fintechs and PSPs

Think of stablecoins as a new settlement layer sitting alongside traditional banking rails. They don’t replace existing systems overnight, but they dramatically reduce friction where legacy infrastructure is slow, expensive, or fragmented.

Within the modern payment infrastructure, stablecoins provide programmable, globally interoperable USD liquidity; available on demand, transferable in near real time, and not dependent on correspondent banking chains.

For African fintechs and PSPs, this has direct and practical implications:

- Faster cross-border payments: Unlike SWIFT transfers that can take days, stablecoin settlements can clear in minutes across jurisdictions.

-

- Lower FX friction: Stablecoins help reduce reliance on volatile local currencies when pricing or settling international transactions.

-

- Programmability: Smart contracts and API integrations enable automated reconciliation and real-time liquidity movements.

-

- Financial inclusion: Stablecoins can extend access to digital financial services in markets where access to USD accounts is limited or expensive.

However, and this is critical, not all stablecoins are created equal. The choice between USDT, USDC, and other alternatives impacts regulatory compliance, counterparty risk, and operational efficiency.

Choosing the right stablecoin doesn’t need to slow you down. Payment infrastructure providers like YoguPay support businesses in implementing regulated stablecoin solutions that reduce friction and unlock faster cross-border settlements.

Understanding the Basics Between USDT and USDC

Before evaluating use cases, it’s essential to understand what these assets are and how they differ under the hood.

USDT (Tether)

Tether, issued by Tether Limited, was the first widely adopted USD-pegged stablecoin. It maintains the peg by holding reserves that claim to back circulating tokens. Tether’s market share often exceeds that of other stablecoins, largely due to early mover advantage and deep liquidity on major trading venues.

However, USDT has historically attracted scrutiny regarding the composition and transparency of its reserve holdings.

USDC (USD Coin)

USDC, co-managed by Circle and Coinbase under the Centre Consortium, emphasizes transparency and regulatory compliance. Its reserves are held in segregated accounts with regular attestations by reputable auditors. Institutions drawn to robust governance frameworks often favor USDC for this reason.

Liquidity and Market Reach

Global Liquidity Dynamics

In fintech terms, liquidity functions much like clearing capacity in a payments network. You can have modern APIs, real-time settlement logic, and robust compliance controls, but if sufficient liquidity is not available at the moment of execution, transactions stall, pricing degrades, or costs increase.

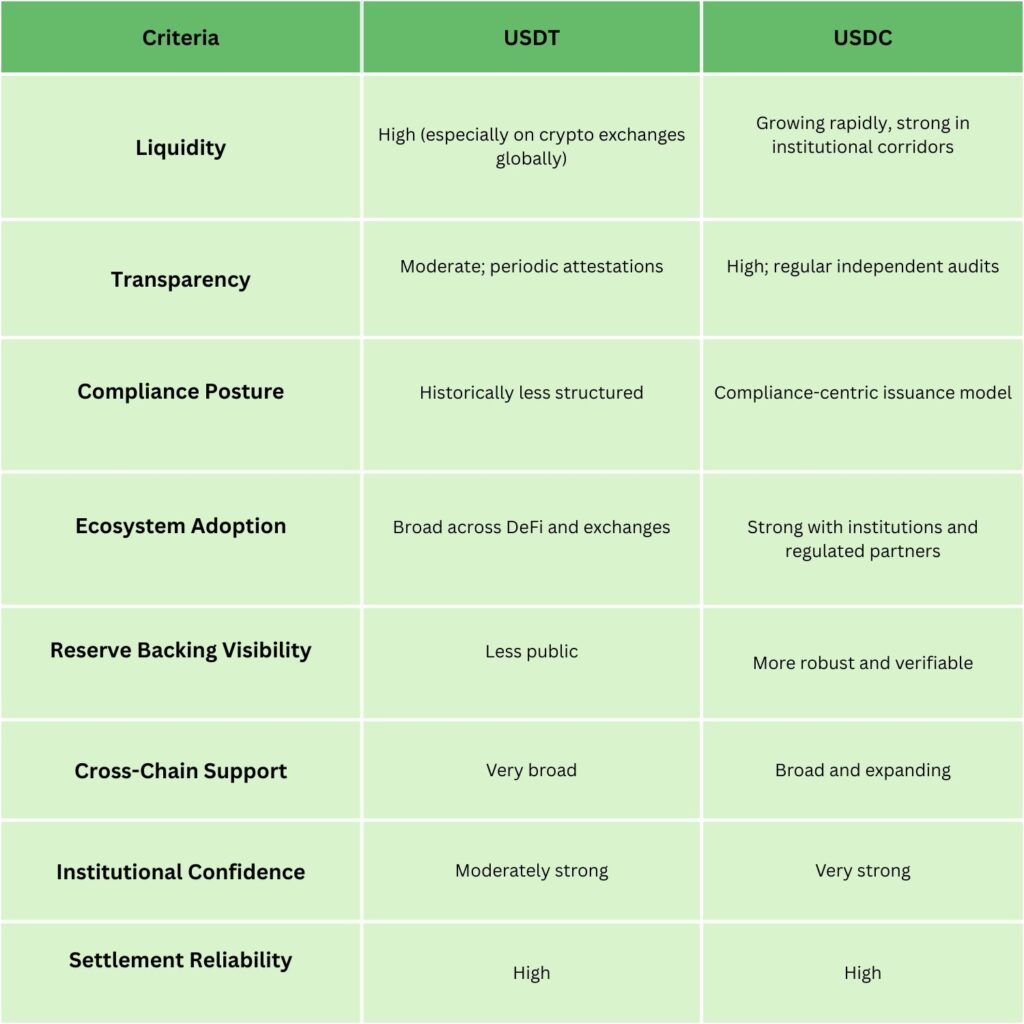

Viewed through this lens, the differences between USDT and USDC become clearer:

- USDT operates like a high-throughput clearing rail. It is widely available, deeply liquid, and accessible across a broad range of exchanges, wallets, and blockchain networks. In corridors where speed, volume, and immediate availability are critical, USDT often provides the fastest path to execution.

-

- USDC functions more like a regulated settlement account. While liquidity may be more controlled, it comes with stronger assurances around reserve transparency, governance, and auditability. This makes USDC particularly well-suited for institutional flows, regulated PSPs, and environments where counterparty risk and compliance alignment are paramount.

For African fintechs and PSPs operating across multiple corridors, the trade-off is not theoretical. Liquidity depth impacts settlement reliability, while transparency and issuer credibility influence regulator confidence and banking partnerships.

As a result, leading payment providers increasingly design multi-asset liquidity settlement architectures, allowing them to route transactions dynamically between USDT and USDC based on corridor conditions, compliance requirements, and cost considerations.

Wallet-as-a-Service providers such as YoguPay enable this flexibility by abstracting stablecoin complexity and providing unified access to multiple liquidity sources without locking operators into a single asset.

Relevance to African Fintechs/PSPs

For African PSPs integrating stablecoin rails, liquidity is essential to avoid slippage, enable efficient settlement, and manage on-chain operations without bottlenecks. That said, liquidity considerations must balance with counterparty risk and regulatory compliance.

Transparency and Compliance as A Core Differentiator

In conversations with compliance officers, the question isn’t whether stablecoins are useful, but whether the risks are manageable and auditable.

USDT’s Transparency Debate

Tether’s reserves have relied on periodic attestations rather than full public audits, leaving some institutional players cautious. The GENIUS Act of 2025 addresses this by requiring fully backed reserves with regular public disclosures and independent audits, improving transparency and auditability.

This regulatory framework gives fintechs and PSPs greater confidence when integrating stablecoins into compliant cross-border payment solutions.

For PSPs, this is especially important when meeting stringent requirements for:

- KYC/AML requirements

-

- Regulatory reporting

-

- Risk management frameworks

For organizations subject to strict compliance oversight, or planning to partner with regulated banks, USDC’s attested reserves and governance model often align better with compliance expectations.

USDC’s Compliance Framework

USDC issuers publish detailed reserve reports and uphold governance principles that resonate with regulated entities. This clarity:

- Reduces counterparty risk

-

- Eases audit procedures

-

- Strengthens relationships with banks and custodians

Put simply, it’s like choosing a vehicle with reliable diagnostics: you understand what you’re operating, can identify potential risk zones, and know how to maintain safe, efficient performance.

API infrastructure providers like YoguPay embed compliance directly into their stack, offering automated regulatory reporting, real-time monitoring, and audit-ready records. This gives fintechs and PSPs a robust risk management framework, enabling them to scale cross-border payments confidently while staying aligned with evolving regulatory standards.

Technical Integration: Smart Contracts, APIs, and Wallet Support

When integrating stablecoins into payments infrastructure, developers and architects need:

- Standard token behavior

-

- Robust API connectivity

-

- On/off-ramp support

-

- Secure custody and transaction monitoring

Token Standards and Protocol Support

Both USDT and USDC are widely supported on multiple blockchains; from Ethereum, to Solana, Tron, and BNB Smart Chain. However, differences in adoption across chains matter operationally:

- USDT’s multichain footprint is expansive, offering availability on networks with lower gas fees like Tron. Gas fees refer to the transaction costs required to process and validate transfers on a blockchain. Lower gas fees mean faster, cheaper transfers, making networks like Tron attractive for high-volume remittances.

-

- USDC is typically the first choice in compliance-sensitive environments and is increasingly supported across leading smart contract platforms.

For developers, the practical implication is that effective integration requires supporting both tokens across multiple chains, with intelligent routing logic that optimizes for cost, speed, and partner-specific requirements.

APIs and Infrastructure Abstraction

This is where WaaS providers like YoguPay enter the picture. Rather than building custom connectors for every chain and every token variant; a process that can take months and significant engineering resources, fintechs can leverage:

- Unified APIs for multi-stablecoin operations

-

- Smart routing between USDT, USDC, and other assets

-

- Plug-and-play settlement endpoints

-

- Automated reconciliation and reporting tools

As an embedded wallet and API provider, YoguPay collaborates with developers and decision-makers to integrate scalable, interoperable, and compliant solutions, leveraging AI-driven compliance checks, automated settlement workflows, and real-time liquidity management.

This approach allows fintechs and PSPs to accelerate time-to-market, reduce operational risk, and deliver seamless cross-border payments without building complex infrastructure in-house.

Cross-Border Settlement: Realities and Opportunities

Traditional FX and Remittance Challenges

African fintechs know all too well the friction in cross-border flows:

- Traditional correspondent banking can be slow and opaque.

-

- FX spreads and conversion fees erode value.

-

- Regulatory controls and multiple intermediaries add latency.

Stablecoins provide an alternative by offering programmable, transparent, and near-instant settlement wherever public blockchains are available. These features also enable treasury teams to optimize liquidity, mitigate FX volatility, and streamline cross-border operations.

Reduce FX risk by integrating stablecoins directly into your payment stack. Connect with a YoguPay advisor to see how you can manage liquidity efficiently and compliantly.

Use Cases in African PSPs

- Remittances: Migrant workers sending money home can benefit from stablecoin corridors that bypass costly intermediaries.

- E-commerce Settlements: Merchants selling globally can receive stablecoins, lock in USD value, and settle into local currency with minimal delays.

- Payroll in USD: Companies with global workforces can pay contractors with stablecoins, reducing FX risk.

- Liquidity Pools for PSPs: PSPs can maintain stablecoin liquidity and deploy it for customer payouts across markets.

However, the operational challenge lies in execution capacities of stablecoins, and not whether they can improve settlement. How to build compliant, scalable rails that integrate into existing finance tasks.

Here again, infrastructure partners like YoguPay help fintechs and PSPs extend traditional settlement rails into the digital asset ecosystem via:

- Modular APIs for wallet creation and management

-

- Smart settlement orchestration across USDT and USDC

-

- Cross-chain liquidity routing

-

- Comprehensive compliance tooling

This lowers the barrier for fintechs to offer global settlement without becoming blockchain experts.

Cross-border payment infrastructure providers like YoguPay offer RESTful APIs designed with built-in compliance and security measures. Rather than reinventing the wheel, fintechs and PSPs can integrate these APIs directly into their payment stack, enabling them to scale operations efficiently without adding overhead or disrupting existing business flows.

Risk Management and Operational Resilience

When discussing stablecoins, it is equally important to consider risk and security, as these factors are inseparable from the effective management of digital assets.

Counterparty and Reserve Risk

- USDT: Historically higher concerns around reserve transparency.

-

- USDC: Higher confidence among regulated institutions due to audited reserves.

Mitigating counterparty risk means:

- Diversifying between stablecoins

-

- Understanding reserve composition and backing

-

- Engaging partners with transparent reporting

Regulatory and Compliance Risk

Many African countries are crafting or revising digital asset regulations. Stablecoins may fall under securities, payments, or FX control laws. In Kenya, the VASP Act of 2025 places stablecoin issuers and operators under formal oversight, ensuring compliant, auditable payment and settlement operations.

PSPs must therefore:

- Understand local regulators’ stance on digital assets

-

- Monitor evolving policies on stablecoin settlement

-

- Prepare for licensing requirements where relevant

Infrastructure providers like YoguPay that bake in compliance workflows; such as transaction monitoring, AML/KYC, and audit trails, help PSPs avoid costly operational risk.

Cybersecurity and Custody Risk

Digital assets change risk profiles for custodial operations:

- Hot wallets are vulnerable to hacks if poorly secured

-

- Cold custody requires secure key management

-

- Third-party custodians can mitigate but not eliminate risk

Partnering with crypto-infrastructure providers that specialize in secure custody and key management allows fintechs to scale without reinventing security mechanisms.

A Comparative Look: USDT vs USDC for African PSPs

Both stablecoins have a role in a diversified settlement strategy. It is not an either/or for many PSPs, but rather a question o f how to orchestrate liquidity efficiently across multiple assets.

Practical Implementation Playbook for African Fintechs

Step 1: Define Your Settlement Needs

Ask:

- Will you support cross-border merchant settlements?

-

- Do you need instant payouts?

-

- What are your regulatory reporting obligations?

Your answers determine whether you prioritize liquidity depth (USDT), transparency/compliance (USDC), or a hybrid model.

Step 2: Map Regulatory Requirements

Some markets may classify stablecoins as:

- Payments instruments

-

- Securities

-

- Commodities

-

- Nothing yet, but under review

Understanding where your product will operate is essential to choosing a compliant stablecoin strategy.

Step 3: Choose Integration Partners

Rather than building every component in-house, fintechs can partner with infrastructure providers to access:

- Wallet creation and management APIs

-

- Cross-chain settlement routing

-

- Compliance and monitoring tools

-

- Liquidity management modules

For example, WaaS providers like YoguPay offer comprehensive infrastructure that abstracts away complexity while enabling robust settlement flows.

Step 4: Design for Redundancy and Risk Mitigation

This includes:

- Multi-stablecoin support

-

- Failover routing between USDT/USDC as conditions change

-

- Built-in reconciliation and audit logs

-

- Secure custody arrangements

Step 5: Pilot and Iterate

Before full-scale rollout:

- Run test cases with real counterparties

-

- Stress-test liquidity pathways

-

- Validate compliance workflows

This iterative approach helps prevent costly rework down the line. Partnering with WaaS and API payment infrastructure providers like YoguPay can accelerate your go-to-market timeline without requiring a complete overhaul of your payment stack. Get in touch for a personalized walkthrough on stablecoin integration and scaling global transactions.

The Role of API Infrastructure and Wallet-as-a-Service in Stablecoin Adoption

If the middle of the fintech stack is the engine room of payments and settlement, APIs and WaaS solutions are the control center.

Why Fintechs Partner with WaaS Providers

Building and maintaining crypto rails internally is complex and expensive. Firms often lack:

- Deep blockchain engineering expertise

-

- Compliance tooling for digital assets

-

- Risk modeling for real-time settlement

This is where partners like YoguPay become strategic enablers. They provide:

- Wallet-as-a-Service: Plug-and-play wallet solutions

-

- Cross-Chain Support: Routing liquidity between blockchains and stablecoins

-

- Settlement APIs: Integrate stablecoin operations into existing flows with minimal friction

-

- Compliance Frameworks: On-chain analytics, AML/KYC integration, and audit trails

By offloading these components, African fintechs can focus on customer experience, product innovation, and growth.

Educating Stakeholders: How to Talk About Stablecoins Internally

At every level of a fintech organization, understanding stablecoins matters.

For Executives

Frame stablecoins as strategic liquidity rails that can:

- Reduce settlement cost

-

- Improve cross-border throughput

-

- Expand global interoperability

For Product Teams

Think of stablecoins as programmable money, not speculative assets. They enable:

- Automated settlement flows

-

- Real-time reconciliation

-

- Integration with wallets and payment endpoints

For Legal and Compliance

Approach stablecoins through the lens of:

- Regulatory classification

-

- Risk exposure

-

- Reporting requirements

-

- On-chain AML monitoring

For Developers

Stablecoins are tokens with predictable behavior; the challenge is integration:

- Choosing the right token standards

-

- Handling multi-chain logic

-

- Managing wallets, keys, and transactions

Real-World Examples: How African PSPs Can Benefit

To illustrate, consider two real-world scenarios:

Case 1: Cross-Border Merchant Settlement

A PSP in Kenya facilitates sales for an online retailer with customers in China. Using stablecoin rails, the retailer’s RMB receipts can settle instantly into the PSP’s wallet, then be converted to Kenyan Shillings on demand, reducing FX exposure, eliminating payment delays, and streamlining cross-border settlement.

Best strategy: Support both USDT (for liquidity) and USDC (for compliance partners) routed via infrastructure like YoguPay’s API.

Case 2: Remittance Corridor

A remittance startup enables workers in the UAE to send USD value home. Traditional remittance costs are high and slow. With stablecoins, funds can move on-chain, settle quickly, and be converted locally.

Best strategy: Optimize for low-fee chains like USDT on Tron, while maintaining compliance reporting via USDC rails.

The Future of Stablecoins in African Fintech

The stablecoin landscape is evolving rapidly, and African fintechs are positioned to benefit from this innovation wave.

Key future developments include:

- CBDCs (Central Bank Digital Currencies): These may coexist with stablecoins and require new integration frameworks.

-

- Programmable Finance: Smart contracts extend stablecoins into lending, escrow, and automated settlement.

-

- Interoperability Protocols: Bridging liquidity across chains with minimal friction.

-

- RegTech Innovations: On-chain analytics feeding into compliance workflows in real time.

To harness these trends, fintechs must adopt flexible infrastructure that can evolve with regulatory and technological shifts. WaaS and API partner ecosystems like those offered by YoguPay help organizations stay agile while scaling stablecoin capabilities.

Conclusion: Choosing What Works Best

When it comes to choosing between USDT or USDC, there isn’t a binary answer, especially for African fintechs and PSPs. USDT is the most preferred option since it offers deep liquidity, and is widely accepted for payments and exchanges. Alternatively, USDC provides transparency and strong compliance signals. Therefore, the smartest strategy for many organizations is going hybrid, supported by resilient infrastructure.

Stablecoins unlock real opportunities for cross-border settlement, liquidity management, and value transfer across Africa’s emerging digital economy. But realizing that value depends on informed choices about risk, integration, and operational strategy.

YoguPay enables fintechs and PSPs through APIs and programmable wallets to accelerate adoption, manage complexity, and focus on delivering high-impact financial services rather than wrestling with the underlying blockchain infrastructure.

Build a compliant, scalable cross-border payment stack with support for USDT and USDC. Speak with our team to deploy API-driven crypto settlement securely and efficiently.