Introduction

The financial services landscape is shifting fast, and stablecoins are emerging as a vital bridge between legacy banking and the digital asset economy. For banks seeking to remain competitive, integrating stablecoins into core infrastructure is no longer optional, but strategic. This article explores how banks can adopt stablecoins to deliver smooth fiat-to-crypto and crypto-to-fiat ramps, reducing friction, improving liquidity, and capturing new value in payments and treasury services.

In 2024, stablecoin transaction volumes surpassed $5.7 trillion, reflecting surging demand for mid-value transfers and settlements. At the same time, respondents in industry surveys report that nearly 90 % of financial institutions are actively exploring stablecoin strategies, with cross-border payments being the priority use case. If banks fail to embrace these rails, fintech challengers and nonbank platforms risk capturing the value chain between fiat and crypto.

This article will define the role of stablecoins, outline integration paths for banks, analyze compliance and risk considerations, present real-world use cases, and offer a roadmap to implementation.

What Are Stablecoins and Why They Matter to Banks

A stablecoin is a digital currency that keeps its value steady by linking it to a traditional currency like the US dollar or euro. In practice, this digital currency serves as a low-volatility bridge between crypto systems and traditional money systems.

Common stablecoin models include:

- Fiat-backed stablecoins like USDC and USDT where reserves such as cash, and short-term treasury instruments that allow users to exchange them 1:1 for cash.

-

- Crypto-backed or algorithmic stablecoins such as DAI which overcollateralize or use algorithmic mechanisms to maintain peg.

-

- Hybrid models combining partial reserve backing with algorithmic adjustments.

In 2025, U.S. dollar–denominated stablecoins remain dominant, representing about 99 % of the market capitalization in many reports.

J.P. Morgan Global Research projects that stablecoin totals could reach $500 to $750 billion in the coming years. These trends suggest stablecoins are not just speculative instruments but are gaining traction as transactional rails.

Relevance to Banks

For traditional banks, examining stablecoins yields several compelling advantages:

Faster Settlement and Liquidity Efficiency

On-chain transfers settle finality nearly instantly or in minutes, unlike clearing cycles for traditional systems that take several days.

Programmability and Automation

Smart contracts enable automated payments, escrow services, and other conditional transactions in business and treasury operations.

Cross-Border Reach

Stablecoins lower dependence on expensive correspondent banks, speed up cross-border transactions, and improve access to underbanked regions.

Retention and Capture of Flows

Without stablecoin infrastructure, banks risk losing transaction volumes to fintech and crypto platforms that serve as intermediaries.

Yet issuing a proprietary stablecoin is not always optimal because fragmentation risk arises when multiple banks issue competing tokens. McKinsey argues that the benefits of issuing a bank’s own stablecoin must be weighed against disintermediation and ecosystem fragmentation.

Thus, many banks will consider acting as custodians, infrastructure providers, or integrators rather than sole issuers.

Why Fragmented Fiat-to-Crypto Ramps Remain a Major Banking Challenge

The main obstacle to mass adoption of crypto and stablecoin systems is the friction involved in converting between fiat and digital assets.

- Delays and settlement lag: Traditional fiat systems often take up to three business days to settle.

-

- High fees and spreads: Intermediaries, currency conversions, and routing across multiple counterparties inflate costs.

-

- Liquidity fragmentation: Local fiat markets differ in depth and accessibility because global stablecoin liquidity is uneven across regions.

-

- User experience complexity: Non-technical users struggle with wallets, blockchain addresses, and compliance flows.

In 2024, stablecoin volumes reached $450 billion monthly, roughly half of Visa’s processing volume, underscoring how crypto rails are scaling rapidly. In later months, reported volumes approached $710 billion, signaling that stablecoins are becoming a defining force in the evolution of global finance. Without integrated on/off ramps embedded in banking interfaces, users and businesses default to offshore exchanges or fintech wallets, bypassing banks altogether.

How Banks Can Build Seamless Stablecoin Ramps

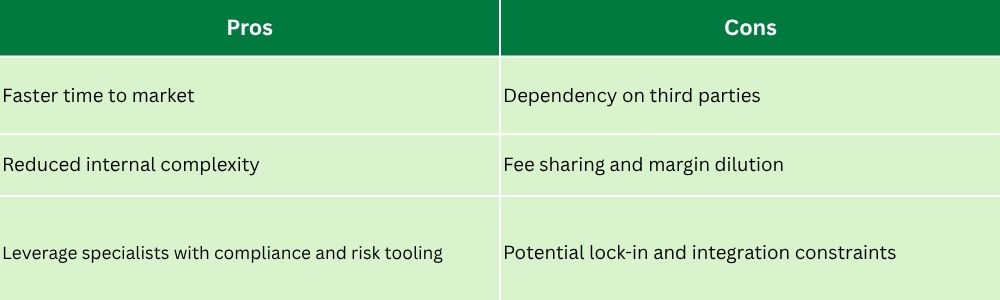

Banks may adopt one or a combination of strategies to integrate stablecoins. Each path has considerations in control, cost, risk, and complexity that must be assessed keenly to land the best solution.

Custodial Issuance Model

In this model, a bank acts as the issuer or co-issuer of a stablecoin, backed 1:1 by its own reserves in fiat or short-term assets. The bank also provides custody, redemption, and minting services.

Because of these challenges, many banks opt to partner with existing brokered stablecoin issuers instead of issuing entirely in-house.

API and On/Off Ramp Gateways

Banks may embed fiat-stablecoin conversion via APIs provided by specialist providers such as YoguPay. The bank retains user interface integration, onboarding, and oversight while outsourcing execution, liquidity, and compliance modules. YoguPay provides a headless on/off ramp API with compliance, KYC, and fraud protection for cross-border payments and remittance rails.

Node Participation and Infrastructure Hosting

Banks may run blockchain nodes or validator infrastructure on public or permissioned networks to gain visibility, control, and reliability in settlement flows. They can also host wallets, indexing services, or bridge operators to support internal processes and client transactions.

With this setup, banks can audit and monitor their stablecoin circulation, enhance security, and reduce reliance on external nodes.

Layer-2 or Institutional Networks

Rather than integrating directly with high-cost base layers, banks may leverage Layer-2 solutions or consortium chains; governed by multiple organizations and optimized for payments, such as Polygon, Stellar, or private institutional networks. The bank can issue stablecoins on these chains, connect to public networks, and operate cross-chain bridges.

These networks often support faster processing, lower fees, and better interoperability with payment protocols.

Core Banking Integration

Whatever the external structure, the stablecoin rails must fit into the bank’s backend which includes the ledger, interface, risk systems, transaction monitoring, and client portals. This requires:

Wallet and account abstraction within banking apps

- Hybrid permissioned on-chain/off-chain reconciliation

-

- Real-time visibility into liquidity and exposures

-

- Integration with AML, sanctions, and compliance systems

Over time, the bank may choose to migrate client flows, payments, and cross-bank settlement onto tokenized rails on the blockchain.

Compliance, Governance, and Managing Risk

Successful stablecoin adoption requires rigorous compliance and control architectures to address regulatory, operational, and financial risks.

Regulatory Landscape

- Europe’s Markets in Crypto Assets (MiCA) provides a regulatory regime for stablecoin issuers, requiring full reserves, disclosures, redemption rights, and licensing.

-

- The U.S. GENIUS Act requires stablecoin issuers to maintain strict reserves, undergo audit, and register with federal regulators, in a bid to protect issuers and users.

-

- Over 60 % of central banks globally are developing stablecoin or token regulation frameworks.

-

- Kenya (VASP Bill): The Virtual Asset Service Providers (VASP) Bill has passed its second reading, placing oversight under the Central Bank of Kenya (CBK) and the Capital Markets Authority (CMA) to enhance market integrity and investor protection.

The country also replaced its earlier 3% Digital Assets Tax with a 10% excise duty on transaction fees charged by exchanges and service providers, marking a shift toward structured taxation and clearer compliance standards.

Banks must monitor these regulatory regimes, ensure licensing alignment, and engage proactively with regulators.

AML, KYC, and Sanctions Screening

On-chain flows must integrate identity verification, wallet screening, counterparty scoring, transaction monitoring, and effect reconciliations with off-chain compliance systems. In addition, banks should adopt hybrid AML/KYC frameworks that can bridge blockchain address risk with client profiles.

Reserve Auditing and Proof-of-Funds

Issuers must prove that each stablecoin is backed by legitimate collateral, hence regular external audits and cryptographic commitments (proof-of-reserves) are critical. Valuation drops can trigger trust crypto crises and runs; where investors withdraw all their coins at once.

Redemption and Liquidity Risk

Even stablecoins can face redemption stress if many users demand fiat conversion simultaneously. Banks must maintain liquidity buffers, redemption gates, or graded redemption policies. Scenario stress tests and fallback mechanisms to backup reserves are essential.

Smart Contract and Operational Security

If programmable chains are used for stablecoin supply, banks must audit smart contracts, implement upgrade governance, and ensure fallback controls. Custodial wallet risk, private key management, back-end system reliability and disaster recovery remain non-negotiable.

Interoperability and Regulatory Boundaries

Banks need to manage interactions across jurisdictions, bridging chains, and variations in token standards, while ensuring compliance across all relevant regulatory domains.

Use Cases and Business Opportunities

Below are areas where banks can unlock value through stablecoin integration.

Cross-Border Payments and Remittances

Stablecoins deliver fast settlement across borders at lower cost and in corridors where traditional remittance fees can exceed 5–7 %. Embedded stablecoin rails can slash that by a significant margin.

Banks can offer clients and remittance customers a more efficient global payments product, integrating crypto rails behind the scenes while preserving familiar user experiences.

Corporate Treasury and Cash Management

Corporations increasingly manage cash liquidity across subsidiaries, geographies, and currencies. Embedded stablecoins allow banks to offer “programmable treasury,” enabling clients to automate cash flows, conditional disbursements, and on-chain liquidity management.

Banks can also internalize settlement between branches or partner banks on token rails, reducing counterparty exposure.

Retail and Deposit Products

Banks may offer clients stablecoin-denominated deposit accounts or yield-bearing products based on regulatory frameworks. Clients will benefit from stronger settlement speed, transparency, and access to programmatic features.

Merchant and SME Settlement

Merchants often prefer quick settlement of payments rather than waiting days via card networks. Banks can offer stablecoin settlement options so merchants receive funds almost instantly in fiat or digital form.

Interbank and FX Settlement

Banks operating across currencies can use stablecoins as synthetic rails for managing FX. For example, a euro-denominated stablecoin could support USD–EUR transfers on a tokenized bridge without legacy correspondent banking chains.

Embedded Finance and Marketplace Platforms

Banks can supply stablecoin rails to platforms, marketplaces, and fintech partners, creating connectivity for third parties to route payments through stablecoin rails embedded in banking infrastructure.

Roadmap to Implementation

Banks should proceed in phases, learning and scaling iteratively rather than undertaking massive cross-enterprise transformation from day one.

Step 1: Pilot Programs and Sandbox Trials

Launch pilot with a select client segment such as high-volume corporate or cross-border remittance under limited volumes and compliance oversight.

Step 2: Partnerships and Infrastructure Providers

In the early stages, banks should partner with API and on/off-ramp providers to reduce infrastructure risk while strengthening internal capabilities. YoguPay exemplifies this model through its RESTful APIs, which unify cross-border payments and remittance corridors across diverse bank-supported payment methods.

Step 3: Interoperability and Network Strategy

Evaluate which chains, Layer-2s, or consortium networks are most compatible with a geography, client base, and regulatory reach.

Step 4: Compliance, Audit and Governance Framework

Deploy robust compliance tools, auditing, proof-of-reserves, stress scenarios, and board-level governance.

Step 5: Integration with Core Systems

Embed stablecoin accounts and logic into digital banking front ends, transaction monitoring systems, risk engines.

Step 6: Scaling and Client Onboarding

Gradually expand availability to retail and SME clients, increasing volume and features.

Step 7: Ecosystem Collaboration

Engage with other banks, payment platforms, regulators, and token standards to enhance interoperability and adoption. For example, European banks recently joined forces to create a euro-backed stablecoin.

Challenges and Considerations

While promising, stablecoin integration is not without hazards.

- Regulatory uncertainty and fragmentation may slow adoption or require rolling compliance changes.

-

- Technology risk and interoperability challenges emerge when coordinating across chains and token standards.

-

- Cultural and institutional inertia means banks often hesitate to adopt blockchain-based models in core operations.

-

- If stablecoins become widespread, bank deposits and credit creation could migrate outside traditional banking models, according to the Federal Reserve.

-

- Negative sentiment or doubts about reserves can trigger mass redemptions and put pressure on stablecoin pegs.

-

- Cybersecurity, key management, and operational resilience must meet the highest standards.

Banks must treat stablecoin integration not just as a fintech feature, but as a core element of their digital strategy and risk framework.

Conclusion

Stablecoins are now vital infrastructure for global payments, and banks that successfully integrate stablecoin on and off ramps can reclaim a central role in cross-border flows, treasury operations, and programmable finance.

By combining partnerships, layered integration strategies, and disciplined compliance frameworks, banks can deliver seamless fiat–crypto connectivity within their existing systems. Those that hesitate risk losing strategic ground to fintechs and digital-native payment platforms.

YoguPay empowers banks to accelerate this transition with secure, interoperable payment connectivity. Its API-driven infrastructure modernizes cross-border transactions, streamlines digital liquidity, and unlocks new revenue without disrupting existing systems. As tokenized money gains momentum, now is the time for banks to lead. Contact us or visit us at www.yogupay.com to partner with YoguPay and future-proof your payment strategy to stay ahead in digital finance.