Introduction

The U.S. dollar remains the global benchmark for finance, but in many emerging markets, its digital alternative is quietly taking over. USDT (Tether), a dollar-pegged stablecoin, is transforming how freelancers get paid, SMEs trade, and families send money across borders. Unlike volatile cryptocurrencies, USDT offers predictability and immediacy, giving businesses a reliable way to preserve value and participate in the global economy.

In Africa and Latin America, where inflation, foreign exchange instability, and fragmented banking systems are everyday realities, adopting USDT is now a practical necessity, and not a speculative experiment. For businesses looking to operate efficiently, expand cross-border, and safeguard earnings, stablecoins are becoming the cornerstone of the future of money.

This article explores why USDT adoption matters today and how Wallet-as-a-Service (WaaS) platforms provide a seamless, compliant way for businesses to integrate stablecoin payments into their operations.

Why USDT Matters in Africa and Latin America

Africa and Latin America face persistent financial challenges that make preserving and transferring value difficult. USDT has become a practical tool to navigate these risks and facilitate faster, more reliable cross-border payments. Here’s why stablecoins matter in these regions.

Africa

- FX shortages and weak currencies: Many African currencies have experienced significant depreciation in recent years, leaving businesses with limited access to stable foreign currency. This has created ongoing challenges for imports, cross-border trade, and maintaining financial stability.

-

- Remittance dependency: Millions of Africans depend on remittances, with inflows reaching around $95 billion in 2024, accounting for 5.1% of the continent’s GDP. Traditional remittance services are expensive, slow, and often lose value through FX spread and fees. This is counterproductive for fragile states that are heavily dependent on remittances.

-

- Stablecoins as escape valves: USDT offers a way to lock in value in USD equivalent without having access to a USD bank account. For example, according to recent data, stablecoin flows in Africa are equivalent to 6.7% of GDP in 2024, one of the highest ratios globally. Moreover, Tether’s USDT dominates stablecoin use in the region.

Latin America

- Devaluation and inflation: Countries like Argentina, Venezuela, and others have seen hyperinflation or repeated devaluation of their fiat currencies. Businesses and individuals in these environments often lose purchasing power rapidly.

-

- Dollar shortages and capital controls: In several countries, it’s difficult or costly to obtain hard currency. USDT helps bypass some of the friction and allows people to hold a dollar-pegged asset.

-

- Barriers to cross-border trade: Exporters, freelancers, and service providers often need to interact with international clients who pay in USD or expect USD value; receiving payments via USDT becomes a more predictable and faster path than many banking/international payment alternatives. Additionally, USDT helps businesses bypass payment barriers in B2B cross-border transactions in Latin America.

USDT in Action

In response to the unique challenges of Africa and Latin America’s financial landscape, transaction preferences are shifting. Many freelancers in cities like Lagos and Buenos Aires now opt to be paid in USDT instead of traditional methods like PayPal or bank transfers, avoiding long processing times, high fees, and currency depreciation.

Small and medium-sized enterprises (SMEs) and merchants are also turning to USDT for cross-border B2B trade, using it as a reliable tool to minimize foreign currency exposure and ensure smoother, faster transactions.

Key Benefits of Accepting USDT

Here are the core advantages a business or freelancer in these regions can expect by accepting USDT:

Currency Stability

Because USDT is pegged 1:1 to the U.S. dollar, it is relatively stable compared to volatile local fiat, helping hedge against local currency depreciation.

Cross-Border Accessibility

Payments can be received from anywhere in the world with Internet access, reducing reliance on SWIFT or bank wire, cutting transfer delays, and reducing or avoiding remittance fees.

Financial Inclusion

Many businesses and freelancers do not have access to USD bank accounts or banks that integrate well with international payments. USDT allows them to access global value without the need for legacy banking infrastructure in foreign currency.

Speed and Cost Efficiency

USDT transfers can be completed quickly and with minimal cost compared to traditional bank wires, currency conversion, or remittance services. Near-instant settlement and low transaction fees make stablecoins an attractive option for businesses, freelancers, and cross-border trade, especially in regions with volatile currencies or limited banking access.

Platforms like YoguPay offer cross-border payment solutions that simplify these transfers, providing businesses with a secure, efficient, and compliant way to receive funds without managing the technical complexities themselves.

Scalability and Professionalism

Having USDT as a payment option signals modernity, reliability, and resilience to currency shocks, making a business more attractive to international clients.

Methods to Accept USDT Payments

USDT acceptance isn’t one-size-fits-all. From basic wallets to advanced payment infrastructure, businesses have multiple pathways to integrate stablecoin payments depending on their scale, compliance needs, and long-term goals.

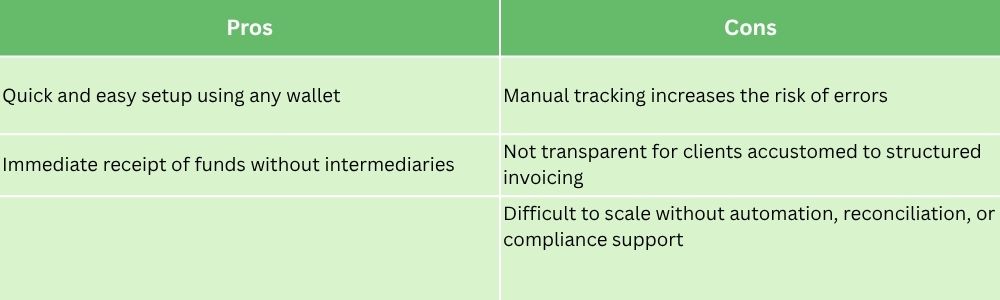

Direct Wallet-to-Wallet

Direct wallet-to-wallet transfer is the simplest method for accepting USDT, where a business or individual shares their wallet address on a specific blockchain, and the payer sends funds directly. This approach allows immediate control over funds without intermediaries, making it appealing for small-scale transactions and users new to cryptocurrency payments.

However, while straightforward, it carries operational challenges:

This option is best-suited for freelancers, small online shops, and peer-to-peer transactions.

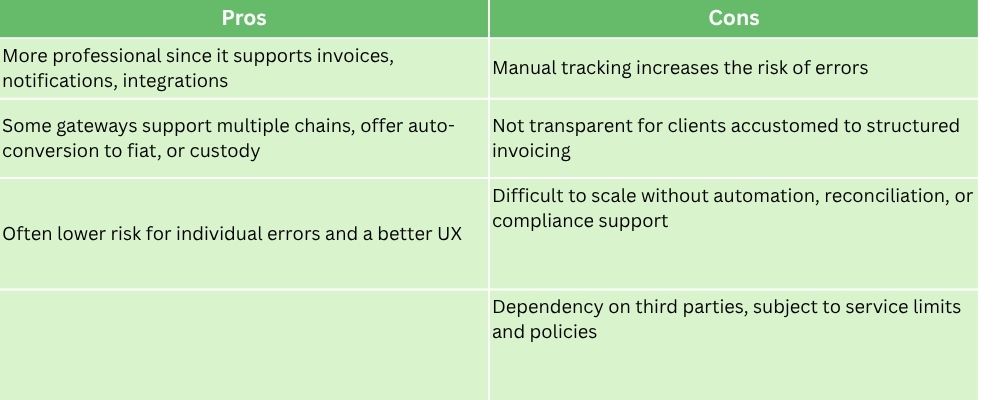

Crypto Payment Gateways

Crypto payment gateways are third-party platforms or services that enable businesses to accept USDT through invoices, payment buttons, or e-commerce integrations. These gateways offer features like multi-chain support, automatic conversion to fiat, and custody solutions, simplifying the payment process and improving the user experience. While they provide a more professional and scalable approach than direct wallet-to-wallet transfers, these gateways come with trade-offs:

Suitable for SMEs, e-commerce merchants, and growing businesses seeking professional and scalable crypto payment solutions.

Peer-to-Peer (P2P) Channels

P2P channels allow individuals to buy or sell USDT directly with one another using platforms such as Binance P2P or local exchanges. Value exchange can be formal or informal, often via bank transfers, mobile money, or cash. This method is highly accessible, particularly in regions with limited formal financial infrastructure, and offers flexibility to negotiate prices and terms locally. However, it carries inherent risks:

Best for individual users, freelancers, or small-scale peer-to-peer trades where formal infrastructure is limited.

Wallet-as-a-Service Payments

For businesses looking to scale, handle cross-border trade, or streamline remittances, Wallet-as-a-Service (WaaS) platforms like YoguPay offer a ready-made solution. WaaS provides APIs and SDKs that let merchants accept USDT and other digital assets, track transactions in real time, and convert funds seamlessly. By embedding compliance, security, and payment management at the infrastructure level, WaaS enables efficient, scalable, and globally-ready payment operations.

What Wallet-as-a-Service offers;

- API-ready wallets

-

- Businesses can issue USDT wallets for clients or receive payments automatically through programmable APIs. This enables automated invoicing, routing, and reconciliation.

-

- Compliance-first architecture

Embedded KYC/AML and necessary compliance checks from day one, so businesses don’t need to stitch together compliance functions or risk non-compliance with local or international law.

- Compliance-first architecture

-

- Multi-chain support

Businesses can accept USDT over multiple blockchains, choosing those with the lowest cost or fastest confirmation for a particular region.

- Multi-chain support

-

- Fiat conversion options

For many business models, holding USDT isn’t enough; converting to local fiat when needed is necessary. On/off-ramp solution providers partner with local exchanges and banking partners to convert stablecoins in ways compliant with local FX and regulatory contexts.

- Fiat conversion options

-

- Scalability, reconciliation, security

Handling many transactions, many clients, or staff payments requires features like accounting trails, deposit tracking, payment status updates, and integration with business accounting or ERP software. WaaS providers like YoguPay aim to provide these building blocks so businesses don’t reinvent the wheel.

- Scalability, reconciliation, security

In summary, direct wallet transfers serve as a basic starting point, while crypto gateways and P2P channels offer intermediate solutions. For businesses focused on scaling, managing risk, and ensuring compliance, Wallet-as-a-Service platforms like YoguPay represent the ultimate solution.

Local Market Realities and Challenges

Accepting USDT isn’t plug-and-play everywhere. There are region-specific realities and challenges that businesses must navigate.

Africa

Regulatory ambiguity:

Many African countries are still defining how stablecoins and digital assets fit into their regulatory frameworks. Nigeria, for example, formally recognized digital assets as securities under the 2025 Investments and Securities Act (ISA), yet restrictions remain on how crypto can be exchanged or used for payments through banks or licensed institutions.

Some exchanges were forced to suspend USDT-Naira trading amid scrutiny from the Central Bank of Nigeria. Meanwhile, Kenya is shifting from its previous Digital Assets Tax (DAT) to a 10% excise duty on certain crypto transactions, signaling evolving approaches to taxation and compliance across the region. These developments highlight the importance of navigating local regulations carefully when adopting USDT in African markets.

Dominance of mobile money: Kenya leads globally with 91% mobile money penetration as of June 2025. In 2024, Kenyans transacted $51 billion via mobile money, with 86% of adults using mobile money for everyday transactions. This widespread adoption, coupled with a robust agent network and regulatory support, presents significant challenges for USDT adoption, which lacks the same infrastructure and regulatory clarity.

FX and bank controls: Some countries impose restrictions on foreign currency transactions, and traditional banking intermediaries may be required to limit crypto-related business. For instance, in Nigeria, lawsuits have been filed against firms trading USDT for Naira without the necessary licenses, highlighting the regulatory risks of operating outside formal frameworks.

Latin America

Regulation emerging but still evolving: Brazil is gearing up to regulate stablecoins and asset tokenization more strictly. The Brazilian central bank has proposed regulations for virtual asset service providers (VASPs), covering stablecoin issuance, distribution, custody, and even placing limits on transfers to self-custodial wallets.

Legal grey zones: Not all countries in Latin America have clear laws governing crypto payments or stablecoins. In markets like Argentina and Venezuela, receiving USDT is technically permissible, but formal recognition, conversion to local currency, and compliance requirements remain unclear. This regulatory uncertainty can expose businesses to operational risks and complicate cross-border transactions.

Language and local integration: Language and local integration are critical for stablecoin adoption in Latin America. Platforms must offer Spanish and Portuguese interfaces, while also connecting with local banks, adhering to foreign exchange controls, and accounting for regional taxes and reporting requirements. Without these adaptations, businesses risk slow adoption, operational friction, and regulatory missteps.

Converting USDT into fiat for daily expenses: Converting USDT into local fiat is a critical step for practical business use. Even when payments are received in USDT, companies need reliable, cost-efficient, and legally compliant methods to convert funds for wages, suppliers, and rent. Without these mechanisms, businesses continue to face currency risk, operational friction, and potential regulatory exposure.

Compliance and Risk Management

Any business accepting USDT must take compliance and risk management seriously. Skipping this exposes companies to legal, operational, and reputational hazards:

- KYC/AML requirements: Businesses must verify clients, understand the source of funds, especially for large transfers, and monitor transactions for suspicious activity to avoid fines or shutdowns.

-

- Regulatory licensing: Many jurisdictions require formal authorization to act as a payment processor, exchanger, or foreign exchange intermediary. In Nigeria, firms offering USDT-to-Naira services without the required licenses have faced lawsuits and even convictions, underscoring the regulatory risks highlighted earlier.

-

- Regulatory risk: Crypto laws in emerging markets are evolving. What is permissible today may be restricted tomorrow, making adaptable infrastructure essential for sustained operations.

-

- Operational security and fraud prevention: Secure private keys, ensure clients send funds to the correct network, and guard against phishing or misdirected transfers to mitigate losses.

-

- Customer education: Clear guidance on chain selection, exchange rates, and fees reduces the risk of mistakes that could harm your reputation and client trust.

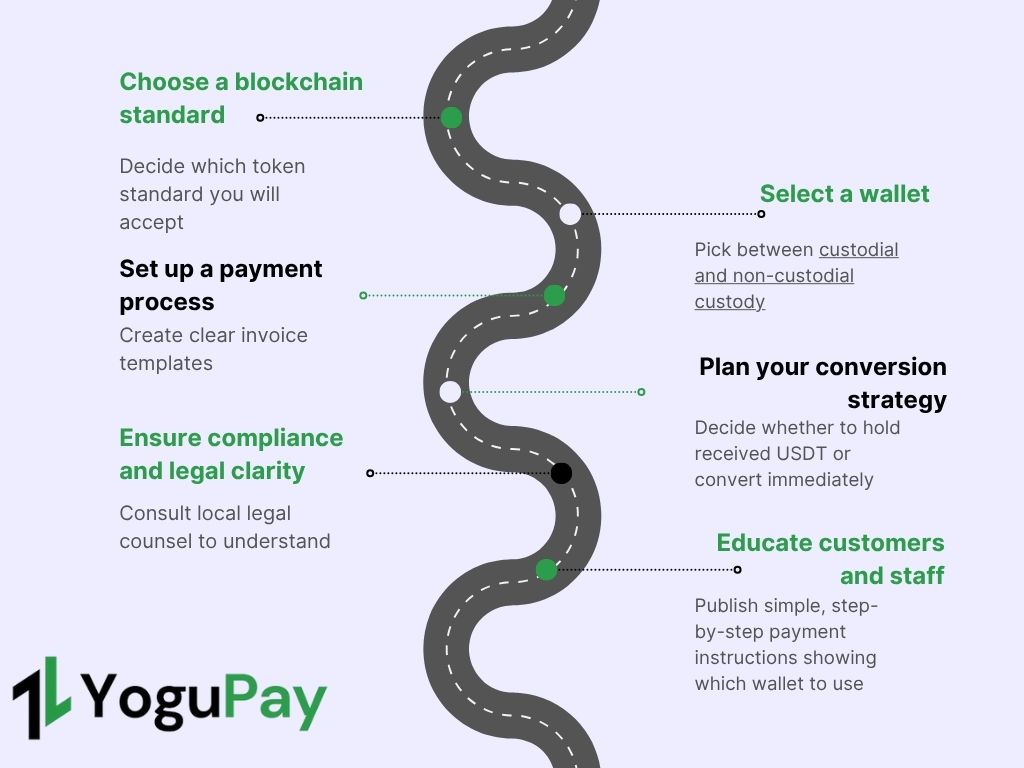

Practical Steps for Accepting USDT Payments in Africa and LATAM

To move from idea to execution, here are concrete steps:

Step 1: Choose a blockchain standard.

Decide which token standard you will accept; for example, TRC-20 on Tron or ERC-20 on Ethereum by comparing transaction fees, speed and local availability. TRC-20 is often preferred for much lower fees, but confirm current gas costs and throughput for your region and check whether local exchanges, wallets, and tooling support the selected chain.

Step 2: Select a wallet

Pick between custodial and non-custodial custody depending on whether you want simplicity or full control. Factor in UX, backup and recovery options, regulatory constraints, and choose reputable providers that match your security and operational needs.

Step 3: Set up a payment process.

Create clear invoice templates that state USDT as payment currency, the exact receiving address, the network/chain, a payment deadline, and any agreed conversion rate. For recurring billing or higher volumes, integrate a payment gateway or API infrastructure like YoguPay’s to automate invoicing, notifications, and reconciliation so payments are trackable and auditable.

Step 4: Plan your conversion strategy.

Decide whether to hold received USDT or convert immediately to local fiat by weighing trade-offs: holding can hedge local currency risk but introduces liquidity and regulatory exposure, while converting reduces crypto exposure but may incur fees and FX losses; establish relationships with reliable, compliant partners or exchanges to ensure fast, predictable on-ramps and off-ramps when you need to convert.

Step 5: Ensure compliance and legal clarity

Consult local legal counsel to understand whether accepting stablecoins or operating conversion services requires specific licenses or triggers foreign-exchange restrictions. In addition, build KYC/AML processes into onboarding and payment flows, keep transaction records, and ensure your tax and reporting practices meet local regulatory requirements.

Step 6: Educate customers and staff

Publish simple, step-by-step payment instructions showing which wallet to use, how to choose the correct network, how to copy and confirm the address, and how customers can verify the transaction; train staff to verify receipts on-chain, handle disputes, manage private keys or custodial account access securely, and follow incident-response procedures so payments are processed smoothly and safely.

Leveraging WaaS for Scalable USDT Payments

For businesses ready to move beyond manual wallets and basic payment setups, Wallet-as-a-Service (WaaS) platforms provide a next-level solution:

- Automated operations: APIs and back-end infrastructure handle invoicing, payment tracking, and USDT-to-fiat conversions, reducing manual reconciliation and operational friction.

-

- Built-in compliance: KYC/AML checks, transaction monitoring, and regulatory reporting are embedded, minimizing legal and operational risks.

-

- Multi-chain support: Payments are accepted across multiple blockchain networks, reducing the risk of lost or misdirected funds.

-

- Fiat conversion: Seamless on- and off-ramp capabilities allow businesses to pay wages, suppliers, and operational expenses in local currency efficiently.

-

- Local integration: Connects to regional banks, accounting systems, and tax frameworks, streamlining financial management and regulatory compliance.

-

- Scalability: Supports growing transaction volumes, multiple clients, and cross-border B2B payments without operational bottlenecks.

-

- Enhanced security and reliability: Secure wallet management, automated reporting, and monitoring help businesses adopt stablecoins confidently while maintaining operational efficiency.

Platforms like YoguPay combine all these capabilities into a single WaaS solution, allowing businesses to focus on growth and cross-border expansion while leaving the complexity of compliance, security, and operational management to the platform.

Conclusion

In Africa and Latin America, USDT has evolved into a strategic tool for businesses, helping them navigate inflation, weak currencies, and cross-border trade challenges. For businesses aiming to scale safely, investing in compliance, reliable infrastructure, and proper conversion processes is essential. Platforms like YoguPay, with WaaS solutions that combine multi-chain support, fiat on/off ramps, and built-in compliance, offer a sustainable path forward.

Take action today. Visit www.yogupay.com and explore how YoguPay can streamline your cross-border payments, reduce regulatory risk, and position your business to grow confidently across volatile markets.