The Stablecoin Promise vs. Reality

Every few years, a new technology bursts onto the financial stage, promising to rewrite the rules. In payments, cryptocurrencies, and specifically stablecoins, which are digital assets pegged to fiat currencies. Industry advocates hail them as a breakthrough, offering low-cost, near-instant, and borderless transfers available 24/7. Yet despite the hype, adoption remains limited.

In payments, utility doesn’t automatically lead to adoption, infrastructure does. Without seamless rails, liquidity management, compliance integration, and developer-friendly APIs, stablecoins are just another speculative asset on the blockchain.

At YoguPay, we see this gap daily. Businesses want stablecoin speed and transparency but face fragmented regulations, illiquid FX markets, and costly settlements. YoguPay’s mission is to make stablecoins work at scale.

Fixing Broken Payments with Stablecoins

To understand why infrastructure matters so much, we need to review the state of global payments today.

Sending money across borders remains painfully slow. Settlement can take three to five business days, intermediaries introduce hidden fees, and FX spreads eat into profits. Global remittance fees average 6.49% per $200 sent, far above the UN’s Sustainable Development Goal of 3%. Businesses suffer too, with cross-border B2B payments often requiring pre-funded accounts, creating cash-flow inefficiencies and locking up working capital.

Stablecoins have disrupted this narrative, with on-chain transfers settling in seconds instead of days. Built-in transparency ensures that anyone can verify a payment’s path. And because stablecoins are pegged to fiat currencies like the US dollar, businesses gain the benefits of blockchain without the volatility risk of traditional cryptocurrencies.

Data shows that daily on-chain stablecoin transaction volumes exceed $20 billion, and total annual flows hit $27 trillion in 2024, a 25x increase from 2020. But despite this meteoric rise, these figures are misleading. Much of that volume is money moving between exchanges (churn). Real-world commerce powered by stablecoins remains less than 1% of global money transfers, underscoring the massive gap between potential and impact.

This is where infrastructure becomes the differentiator.

Stablecoins Without Infrastructure Are Highways Without Ramps

Stablecoins are technically sound, but without essential elements such as on-ramps, fiat conversion, compliance, and liquidity, they can’t deliver seamless payments.

In emerging markets, this problem is magnified. Africa, for example, is a continent of fragmented regulations, diverse mobile money ecosystems, and currency volatility. Businesses and consumers face barriers at every step:

- A remittance from London to Lagos may involve four intermediaries before payout.

-

- Local businesses often receive cross-border payments in USD, only to lose margins when converting to local currency.

-

- Compliance checks are manual, duplicative, and slow.

Stablecoins can solve these issues, but only with rails to plug into. YoguPay provides that bridge: compliant, liquidity-ready infrastructure.

YoguPay’s Role in Building the Rails

YoguPay is building the infrastructure that makes stablecoin-powered transactions possible and effortless.

- Multi-Currency Wallets and On/Off-Ramps: Businesses can collect and disburse stablecoin payments in local currencies via on/off ramp solutions, connecting to mobile money, banks, and e-wallets.

-

- Real-Time FX Liquidity: Automated conversions reduce the need for pre-funding accounts and protect against currency volatility.

-

- Embedded Compliance: Integrated KYC/AML solutions meet local and global regulations, reducing onboarding times and risks.

-

- Developer-Friendly APIs: Instead of spending months building blockchain expertise, fintechs integrate YoguPay’s RESTful APIs to enable global payouts.

This approach reflects a deeper belief that payments innovation is only as powerful as the infrastructure behind it.

Why Emerging Markets Will Lead

The future of payments will not be shaped by New York or London. It will be determined by markets like Nairobi, Lagos, Cape Town, and São Paulo.

In these regions, mobile money adoption already outpaces traditional banking. Kenya’s M-Pesa processes more than 50% of the country’s GDP annually, and Africa boasts over 1.1 billion active mobile money accounts. Yet cross-border payments remain slow and expensive.

Dollar-pegged tokens sidestep local currency shortages, simplify international trade, and provide an always-on settlement layer. In Latin America, 71% of firms already use stablecoins for cross-border payments, and 92% say their wallets and APIs are ready for scale.

YoguPay is tapping into this readiness, starting with Africa but expanding globally. By integrating with mobile money networks, partnering with banks, and providing FX automation, YoguPay ensures stablecoins aren’t just another blockchain venture, they’re a lifeline for SMEs, freelancers, and remittance providers.

Stablecoins Alone Won’t Win. Infrastructure Will

One common misconception is that blockchain alone can disrupt global finance. In reality, technology is not the bottleneck, adoption is. Businesses don’t adopt tech because it’s trendy; they adopt it when it’s simple, compliant, and reliable.

That’s why YoguPay’s infrastructure-first approach is so powerful:

- For fintechs: Instead of spending millions building internal rails, they integrate YoguPay APIs and focus on their customers.

-

- For enterprises: YoguPay enables treasury teams to manage liquidity in real time and move funds globally at a fraction of traditional costs.

-

- For regulators: Transparent transaction monitoring builds trust in stablecoins, fostering better regulatory clarity.

Payments’ history reveals that innovation rarely wins on product alone, but on the networks and infrastructure behind it. Visa’s dominance wasn’t merely a success of the credit card, it was the seamless, global payment network that made those cards universally accepted. Similarly, PayPal didn’t disrupt e-commerce simply by introducing a digital wallet; its true breakthrough was building the rails that enabled secure, instant internet transactions at scale.

Stablecoins will follow this same path. Their value won’t be determined by the tokens themselves, but the architecture that allows them to function as reliable financial infrastructure.

The Numbers Behind the Shift

Let’s put scale into perspective:

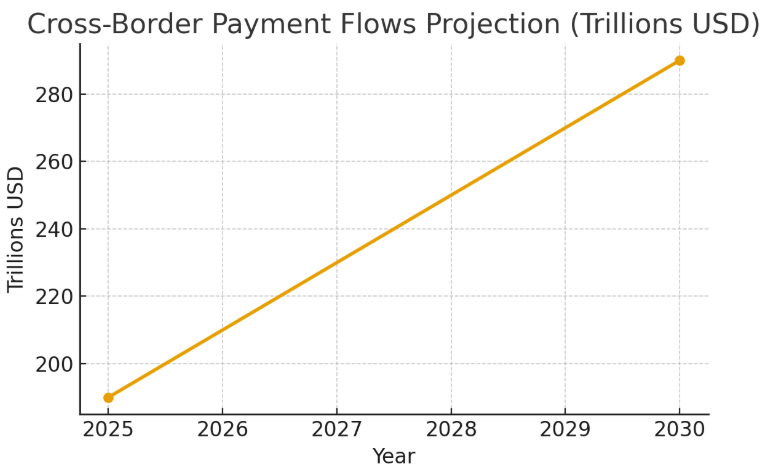

- Cross-border payment flows are projected to exceed $290 trillion annually by 2030. This is not just growth, it’s an unprecedented migration of value across borders, creating demand for faster, cheaper, and more transparent rails.

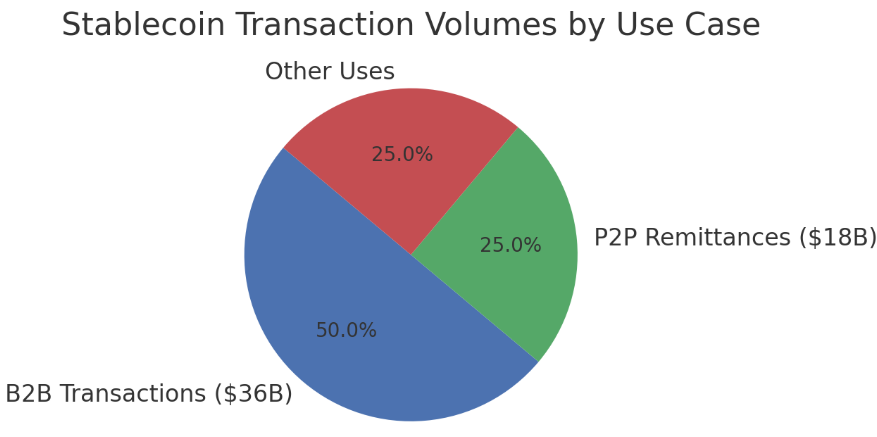

- Stablecoin adoption is already reshaping enterprise finance, with B2B transactions accounting for roughly 50% of all stablecoin volumes ($36B annually) and P2P remittances contributing another 25% ($18B). The narrative is shifting from crypto speculation to enterprise-grade settlement.

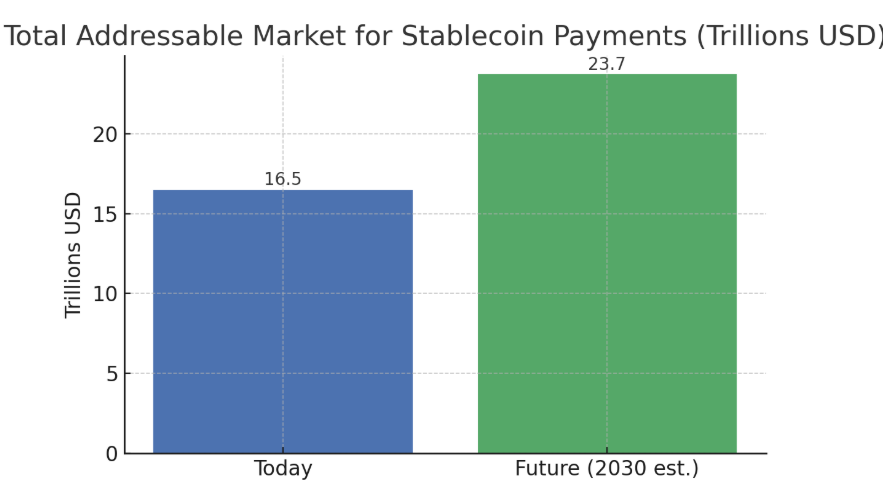

- The total addressable market for stablecoin-powered payments sits at $16.5 trillion today and could climb to $23.7 trillion as digital wallets, APIs, and compliance solutions mature.

With figures this staggering, the debate is no longer about whether stablecoins will shape the future of finance; it’s about how fast they’ll embed themselves into the monetary rails powering global trade. The next wave of disruption will not come from new coins or exchanges but from infrastructure players that can bridge regulatory environments, connect fragmented payment networks, and provide liquidity at scale.

Why This Matters for the Financial Industry

If you’re a fintech founder, treasury executive, or even a policymaker, here’s what this all means:

Stablecoins are no longer optional

What began as an experiment in digital currency is now a foundational layer of commerce. Stablecoins are gaining traction in high-growth markets where traditional banking rails fall short, making them indispensable for treasury operations, merchant payments, and cross-border trade.

Infrastructure is the ultimate differentiator

The rails behind tokens are the innovation, not stablecoins themselves. Compliance frameworks, liquidity access, and interoperability are the deciding factors that determine who leads. Just as Visa’s success was built on network effects, stablecoins will be defined by the strength of their underlying liquidity channels.

Emerging markets are the testing ground

Africa and Latin America are leapfrogging outdated payment systems, proving stablecoin-powered solutions can scale faster in markets with high mobile adoption and regulatory agility. What works in Nairobi or São Paulo today will set the precedent for Western markets tomorrow.

Execution is the competitive edge

The debate over whether stablecoins have a role is over. Now it’s about who moves fastest. With regulatory clarity improving globally, companies that integrate with mobile money, automate FX, and meet compliance at scale will write the next chapter of global payments.

Regulations like MiCA in Europe and the U.S. GENIUS Act are setting the blueprint, creating guardrails that other jurisdictions are likely to mirror or build upon.

The Future of Programmable Money Built on Rails

Looking ahead, stablecoin infrastructure will not only move money, but also automate entire financial workflows and embed intelligence into transactions. Key structural shifts already transforming global payments include:

- Escrow and milestone-based payments without intermediaries: Funds release automatically when shipment or contract conditions are met, removing friction and speeding up operations.

-

- Instant settlements between suppliers and marketplaces: Stablecoin Payments settle in seconds, freeing working capital and reducing dependency on credit.

-

- FX management built into every transaction: Currency conversion becomes invisible and automated, optimizing exchange rates in real time.

This evolution shifts payments from a ‘send money’ model to a ‘program money’ ecosystem, where financial actions are triggered automatically by smart contracts, data, or milestones. To unlock this future, businesses need invisible yet indispensable financial rails, infrastructure that quietly powers liquidity, compliance, and interoperability at scale.

Companies that invest in building this infrastructure now won’t just process payments but will own the backbone of tomorrow’s global commerce.

The Strategic Builders Will Win

Stablecoins are useful, but their real power lies in the infrastructure supporting them. Companies that engineer robust, scalable and regulatory-compliant networks are poised to define the future of global finance.

YoguPay is laying the digital payment foundation brick by brick. Every API we deploy, and every compliance standard we integrate is geared towards building an environment where commerce is instant, inclusive, and visible.

Our mission is to build the invisible backbone for remittances, cross-border transfers, and digital payments – a scalable network built to handle massive volumes while empowering businesses across every market.