Kenya’s decision to legislate virtual asset service providers (VASPs) has transformed an ambiguous regulatory frontier into an actionable roadmap for industry players, banks, fintechs and custody providers. That shift; shaped by the Virtual Asset Service Providers (VASP) Act, 2025 makes compliance a competitive advantage, not merely a checkbox.

In that new reality, Wallet-as-a-Service (WaaS) platforms emerge as the operational “compliance engine” for the country’s emerging digital-asset economy: the layer that consolidates licensing rules, enforces KYC/AML, automates reporting and embeds risk controls directly where wallets, tokens and fiat interact.

This article explains why WaaS is an essential infrastructure for regulatory alignment in Kenya, how it plugs into the VASP Act, the technical and organizational features regulators will expect, and practical steps Kenyan firms should take to transform compliance into growth. Throughout, we relate technical concepts to policy realities and offer a roadmap for fintechs, PSPs, banks and virtual asset service providers who want to move from uncertainty to market leadership.

Why Kenya’s VASP Act is a Gamechanger

Prior to the enactment of the VASP Act 2025, and its official commencement on 4 November 2025, many Kenyan businesses and startups operated in a legal gray zone: active innovation on one hand, and regulatory uncertainty on the other.

The new digital asset law provides:

- A licensing framework that identifies who must register and be supervised as a VASP.

-

- Clear AML/CFT obligations such as; KYC, transaction monitoring, reporting and recordkeeping) and criminal/administrative penalties for non-compliance.

-

- Supervisory powers for regulators to issue rules, inspect firms and suspend services if public interest is threatened.

Those changes mean the cost of non-compliance is no longer theoretical. The law introduces fines and, in serious cases, criminal liability; a signal that regulators expect robust systems, not promises. For adaptive fintechs, that creates a market: firms that can show they are compliant will win trust from banks, PSPs, institutional counterparties and international partners.

What is Waas and Why Does It Matter to Regulators?

Wallet-as-a-Service (WaaS) is a managed platform that provides wallet creation, custody, key management, transaction signing, and user onboarding capabilities as a cloud service. WaaS abstracts complex cryptographic operations and offers APIs so businesses can add wallet functionality without building blockchain infrastructure from scratch. WaaS enablement partners like YoguPay give PSPs and fintechs a quick launchpad with compliant API infrastructure, accelerating time-to-market while reducing the cost and complexity of regulatory alignment.

Why does this matter for the government and supervisors?

1 .Control points: Wallets are the points where real-world identities meet crypto value transfers. Embedding compliance at the wallet layer gives supervisors and auditors tamper-resistant records.

2. Standardization: WaaS providers can enforce consistent KYC/AML lifecycles and monitoring rules across clients, reducing regulatory fragmentation.

3. Auditability: Professionally managed wallets provide logging, immutable transaction history and reconciliations; features regulators require for investigations and ongoing supervision.

4.Security: Reputable Wallet-as-a-Service providers like YoguPay maintain enterprise-grade key-management using Hardware Security Module (HSMs) and Multi-Party Computation (MPC) technology, and can reduce custody risk for clients with limited security expertise.

Taken together, WaaS offers a practical path to operationalizing regulatory obligations: license-ready infrastructure, reusable compliance modules, and end-to-end auditability.

Five Compliance Capabilities a Kenyan Wallet-as-a-Service Must Provide

If the Virtual Asset Service Providers Act, 2025 has one clear implication for technology vendors, it is this: regulators will judge the process as much as the product. A WaaS provider that wants to be the backbone of Kenya’s compliant digital-asset market must deliver the following capabilities.

1. Identity lifecycle (KYC/KYB) integrated with wallet provisioning

Third party wallets should allow identity verification to be a prerequisite to wallet creation and to support tiered access such as; spend limits, and transaction types based on risk profiling. That means direct integrations with identity verification providers, document verification, and business (KYB) screening services.

2. Real-time transaction monitoring and alerting

The platform should include rule engines that detect suspicious activity, such as high-value transfers, unusual counterparties, and chain-hopping, while automatically exporting alerts to AML analysts and regulators. Monitoring must cover both on-chain and off-chain transaction rails.

3. Strong custody and cryptographic key controls

Regulators require robust key management, including hardware security modules (HSMs), multi-party computation (MPC), and role-based operational controls, alongside policies for backup, recovery, and incident reporting. Leveraging a certified Wallet-as-a-Service (WaaS) solution can simplify custody compliance and reduce the operational burden for clients.

4. Reconciliation and regulatory reporting

A WaaS solution should offer automated reconciliation across wallets, fiat rails, and internal ledgers, along with standardized reporting bundles. These include transaction histories, KYC logs, and suspicious activity reports; to meet regulator requests and audit requirements.

5. Policy-driven compliance templates

With the Kenya VASP Act being implemented alongside subsidiary regulations and supervisory guidance, a Wallet-as-a-Service should offer configurable policy templates. These templates should cover KYC thresholds, PEP lists, sanctions screening, and transaction limits to help firms adapt seamlessly to evolving regulatory requirements.

How WaaS Operationalizes Specific VASP Act Obligations

This framework maps key VASP Act requirements to specific WaaS features, turning compliance from abstract legal obligations into practical, executable processes that can be implemented across wallets, fiat rails, and reporting systems.

Obligation: Licensed operation and local agent/registered presence

WaaS response: Provide a compliance dashboard that records corporate user details, proofs-of-presence, delegated admin controls and automated reminders for license renewals and regulatory filings. This becomes a single source of truth during licensing inspections.

Obligation: KYC and ongoing customer due diligence

WaaS response: Enforce KYC at onboarding with risk stratification and periodic re-checks. Enable dynamic KYC that escalates verification when transaction patterns change.

Obligation: Transaction monitoring and suspicious activity reporting (SAR)

WaaS response: Offer a rules engine that watches token flows, chain addresses, counterparties and velocity; generate SAR packets with contextual metadata and export capabilities compatible with regulator formats.

Obligation: Record-keeping and auditability

WaaS response: Store tamper-evident logs, signed attestations of transaction states, and reconciliations between fiat rails and token balances to satisfy inspections and audits. All records should be auditable and retained for up to seven years, ensuring long-term compliance with regulatory requirements.

Obligation: Prudential safeguards (custody, segregation)

WaaS response: Enforce custodial segregation and multi-tenancy controls, while using certified HSM/MPC key storage and maintaining strict role separation between operators and auditors to protect assets and ensure regulatory compliance.

By translating legal duties into platform features, WaaS makes compliance measurable, repeatable, and auditable. YoguPay embeds these compliance capabilities into its platform from day one. Automated monitoring, reconciliations, and secure key management ensure adherence to AML/CFT and custody standards. Partners gain auditable workflows and regulatory-ready reporting. This enables seamless, compliant cross-border settlement and positions YoguPay as a trusted service provider in Kenya.

Why banks and PSPs should prefer WaaS partners

Banks and payment service providers (PSPs) are highly risk-sensitive, as new entrants with weak controls can pose contagion risks to correspondent relationships. WaaS offers a fast, compliant path to integration, reducing both reputational and operational risk for partners and enabling smoother access to banking and payment networks.

- Faster onboarding of VASP clients: Banks can partner with regulated WaaS vendors to pre-screen VASP customers and rely on their attestations during KYC.

-

- Lower operational burden: Banks avoid building wallet stacks from scratch and reduce in-house cryptography and security costs.

-

- Interoperability with legacy rails: Good WaaS providers build connectors to fiat on/off ramps and central bank settlement systems, easing reconciliation and reporting. This also simplifies FX management in the age of stablecoins, streamlining crypto operations for first-adopters.

For Kenyan banks, which balance the realities of mobile-money dominance, highlighted by M-Pesa’s multi-million subscriber base, with the new VASP obligations, partnering with WaaS providers offering compliant stablecoin rails presents a compelling business case.

A Practical Example: Regulated Stablecoins, Remittance and Waas

One of the most compelling use cases for Kenya is cross-border settlement using regulated stablecoins. Stablecoins can compress settlement times, reduce correspondent bank fees and offer transparent audit trails. But to reach scale, stablecoin flows must be integrated with compliant wallets and on/off ramps; exactly where WaaS operates.

End-to-end flow with WaaS:

- Customer (payer) completes KYC in the merchant app.

-

- Merchant’s wallet, provisioned by WaaS mints or receives stablecoins on a regulated on-ramp.

-

- Stablecoins transfer on-chain in seconds; Custodial wallet monitoring flags transfers crossing thresholds or involving high-risk jurisdictions.

-

- Recipients redeem stablecoins for local fiat via WaaS-connected on-ramp; reconciliation batches are created automatically for regulator inspection.

Platforms like YoguPay enable this end-to-end workflow with fully compliant cross-border settlement rails. This platform integrates regulated on- and off-ramps, automated reconciliation, and real-time monitoring. Partners can move stablecoins quickly while maintaining auditable controls and AML/KYC compliance. This makes YoguPay a trusted choice for merchants, PSPs, and payment rails looking to scale securely in Kenya’s licensed digital asset ecosystem.

Implementation Considerations for Kenyan Regulators and Supervisors

Regulators must strike a balance between fostering innovation and ensuring prudential safety. To support the safe adoption of WaaS while maintaining effective oversight, the following supervisory approaches should be considered:

1 .Regulatory sandboxing for WaaS vendors: allow limited pilots to assess operational risk and reporting formats.

2. Vendor certification & baseline standards: Publish minimum technical standards, including key management and incident response requirements, that WaaS providers must meet to be officially recognized or “recommended” for VASP applicants.

3. Standard reporting schema: mandate machine-readable SAR and transaction reporting formats so WaaS vendors can automate submissions.

4. Third-party audit requirements: Require periodic audits, including SOC2 or ISO27001 certifications plus crypto-specific attestations, along with verifiable evidence of transaction integrity.

5. Public-private working groups: bring together banks, PSPs, WaaS vendors and VASPs to iterate on policy and practical guidance.

These steps would reduce friction for VASPs while enabling regulators to scale oversight effectively. YoguPay is already aligned with these standards, embedding robust MPC key management, automated reporting, and independent audit readiness into its platform, ensuring partners can integrate seamlessly while meeting current and forthcoming regulatory expectations.

Risk Management: What Regulators and Firms Must Watch For

Digital asset risk management remains critical for VASPs; while WaaS significantly reduces operational and compliance burdens, it does not eliminate risk entirely.

Key residual exposures include:

- Concentration risk: over-reliance on a single WaaS vendor creates systemic exposure. Mitigation: mandates for contingency plans and multi-vendor architectures.

-

- Vendor compromise: a breach at the WaaS provider could expose keys or data. Mitigation: strong HSM/MPC, zero-knowledge custody options, and verifiable attestation.

-

- Regulatory arbitrage: if policy differs across jurisdictions, wallets might route flows through weaker jurisdictions. Mitigation: geo-fencing rules and regulator coordination.

-

- Operational disagreements: Questions may arise over who is accountable when funds are lost: the merchant, the WaaS provider, or the PSP. Mitigation requires clear contractual liability frameworks and mandatory insurance or reserve arrangements. For global VASPs, the U.S. GENIUS Act offers a relevant benchmark by protecting stablecoin users during insolvency through strict reserve, segregation, and audit requirements.

A thoughtful supervisory framework encourages vendors and clients to build for resilience, not just speed. YoguPay addresses these risks through multi-layered custody, automated monitoring, and audit-ready systems, ensuring that partners benefit from fast, compliant, and resilient settlement rails.

Commercial Models: How Waas Monetizes Compliance

WaaS vendors typically generate revenue through multiple channels:

- Per-wallet or per-transaction fees: charging for each active wallet or processed transaction provides predictable, usage-based revenue.

-

- Premium compliance modules: offering enhanced KYC, sanctions monitoring, automated suspicious activity reporting, and bespoke reporting packages allows clients to scale compliance capabilities without building them in-house.

-

- Managed custody and insurance products: providing secure key management, insured wallets, and disaster recovery services addresses regulatory prudential requirements while reducing client risk.

-

- Integration and professional services: assisting banks, PSPs, and fintechs with onboarding, API integrations, and workflow automation ensures faster go-to-market and operational readiness.

From a buyer’s perspective, the total cost of ownership often favors Wallet-as-a-Service, particularly for smaller PSPs and startups that would otherwise invest heavily to meet the VASP Act’s technical standards. YoguPay combines all these commercial capabilities in a single, fully compliant platform, enabling partners to access secure wallets, regulated on/off-ramps, and automated compliance tools without building costly infrastructure from scratch.

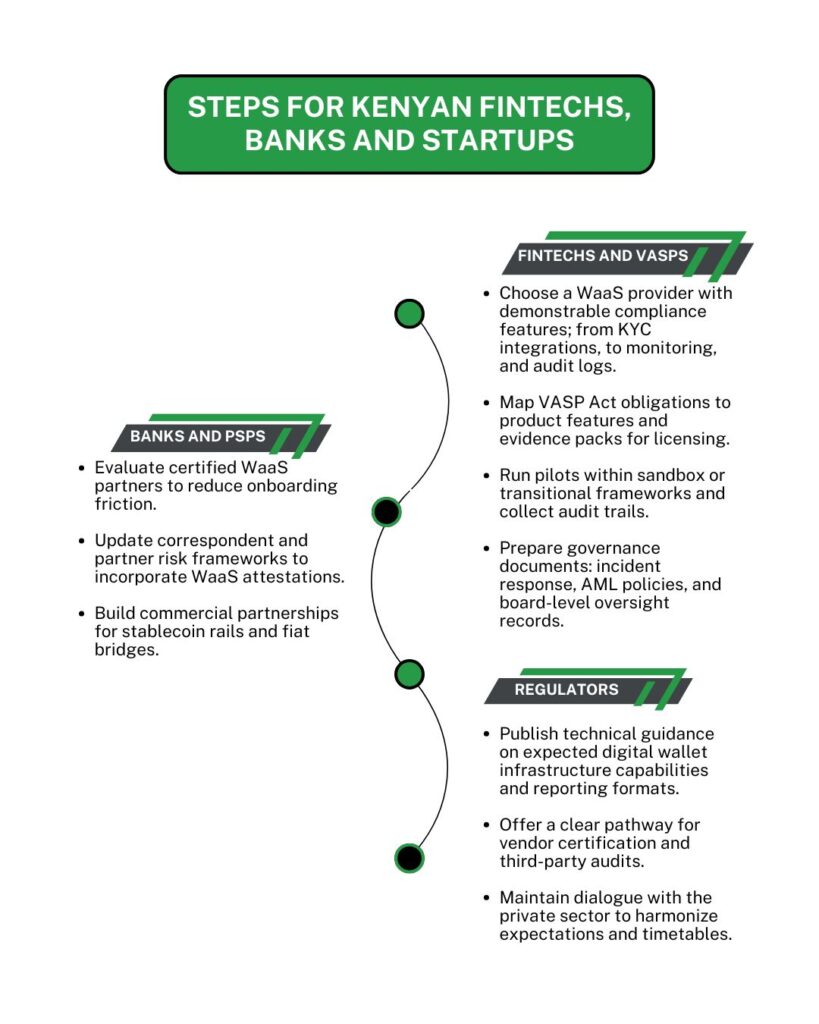

Roadmap: Steps For Kenyan Fintechs, Banks and Startups

The Competitive Case: Compliance as Product Differentiation

Regulatory compliance is shifting from an invisible cost center to a visible source of competitive advantage. Firms that can market themselves as “licensed,” “audit-ready,” and offering “regulated stablecoin rails via certified WaaS” will earn trust from institutional clients, banks, and international partners. That trust translates directly into faster partnerships, reduced onboarding friction, and ultimately greater market share.

Local Dynamics and the Path to Scale

Kenya presents unique advantages that make adoption of digitally managed wallets particularly compelling

- High digital payment penetration: over 90% of Kenyan adults use mobile or digital payments, demonstrating widespread familiarity and trust in platformed money.

-

- Regulatory clarity from the VASP Act: the law provides predictable supervisory expectations for VASPs and the supporting infrastructure, reducing uncertainty and operational risk.

-

- A vibrant fintech ecosystem: local startups and established players are actively experimenting with cross-border flows, stablecoins, and digital settlement, creating strong demand for compliant rails.

These factors suggest that Kenyan institutional wallet providers, or global vendors entering the market, have a clear path to scale rapidly. The critical condition for success is embedding compliance into product design from day one, turning regulatory adherence into a strategic advantage rather than a checkbox exercise.

Recommendations for Policy-Makers and Supervisors

1. Recognize certified WaaS providers as compliance facilitators: Regulators should formally accept audit reports and attestations from certified WaaS providers as part of VASP licensing applications. This reduces duplication of effort, accelerates onboarding, and encourages firms to leverage pre-vetted compliance infrastructure.

2. Issue technical guidance early: Clear, detailed guidance on machine-readable reporting formats, KYC/AML thresholds, and transaction monitoring expectations allows VASPs and WaaS providers to build systems that meet supervisory requirements from the outset. Early guidance reduces ambiguity, lowers operational risk, and enhances overall regulatory effectiveness.

3. Promote vendor plurality: Encourage interoperability between custodial wallet vendors, banks, and PSPs to prevent over-reliance on a single provider. Multi-vendor architectures reduce systemic concentration risk, improve resilience, and allow firms to scale without being locked into one platform.

4. Support sandboxing and pilot programs: Regulatory sandboxes provide a controlled environment where PSPs, banks, and WaaS vendors can experiment with OTC desks, cross-border flows, stablecoin settlements, and compliance workflows. Supervised pilots allow regulators to observe operational risk, test reporting formats, and identify practical challenges before full-scale deployment.

5. Invest in regulator capability: Equip supervisory teams with advanced forensic tools, on-chain analytics, and staff trained in blockchain and digital asset operations. Enhanced capability ensures regulators can effectively monitor VASP activity, detect anomalies, and enforce compliance while still enabling innovation.

API providers like YoguPay align with these policy objectives, offering certified Wallet-as-a-Service infrastructure services that simplify compliance for VASPs. Our platform provides audit-ready reporting, secure custody, and interoperable settlement rails, enabling partners to scale confidently while meeting Kenya’s emerging regulatory standards.

Challenges and the road ahead

Crypto wallet infrastructure offers powerful tools for compliance and operational efficiency, but it is not a silver bullet. Key considerations for regulators and market participants include:

- Ongoing investment: WaaS platforms require continuous updates in security, compliance, and governance to remain effective and resilient.

-

- Regulatory agility: As subsidiary rules and guidance under the VASP Act evolve, WaaS vendors must iterate quickly to maintain alignment.

-

- Legal accountability: License holders cannot outsource responsibility; ultimate compliance and legal obligations remain with the VASP.

-

- Cross-border coordination: Kenya’s digital asset leadership will scale only if counterparties in partner markets recognize and trust compliance attestations and operational guarantees from Kenyan WaaS providers.

Success in Kenya’s digital asset economy depends on a combination of robust WaaS adoption, proactive regulatory oversight, and international acceptance of compliant operations. Firms that integrate these elements early will lead the market, while others risk falling behind.

YoguPay proactively addresses these challenges with a platform built for continuous compliance, secure custody, and automated monitoring. These systems are designed to adapt quickly to evolving VASP rules, while maintaining auditable records and operational guarantees. By partnering with banks, PSPs, and fintechs, YoguPay ensures cross-border settlement flows are trusted and scalable.

Conclusion: building Kenya’s compliance engine

The VASP Act has transformed uncertainty into a clear regulatory playbook, and in this new environment, Wallet-as-a-Service platforms function as the operating system for compliant digital-asset products. By embedding KYC, AML/CFT monitoring, secure custody, and audit-ready reconciliation into wallet workflows, WaaS becomes the engine that enables safe, scalable innovation.

For Kenyan fintechs, banks, and supervisors, the path forward is regulation-by-design: partner with WaaS providers that offer verifiable audits, flexible policy controls, and stablecoin rails built for compliance from day one.

YoguPay delivers the compliant API infrastructure needed to launch cross-border payments and regulated digital-asset products with confidence. To explore how our platform accelerates your regulatory readiness and product deployment, visit www.yogupay.com or contact our team for a demo.